-

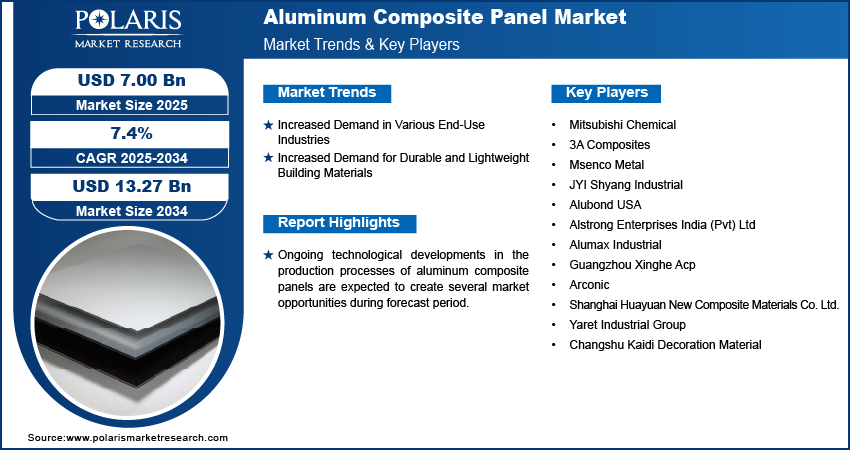

The aluminum composite panel (ACP) market continues to establish itself as a core material in global construction and manufacturing. Valued at USD 6.53 billion in 2024, the market is expected to expand from USD 7.00 billion in 2025 to USD 13.27 billion by 2034, representing a CAGR of 7.4% during the forecast period. The growth trajectory is closely linked to product differentiation, application-specific growth, and value chain optimization, as stakeholders increasingly assess ACP adoption across diverse market segments.

By product type, fire-resistant ACPs represent the fastest-growing segment, reflecting heightened regulatory oversight and safety compliance in both developed and emerging economies. According to the European Commission’s building standards, stricter non-combustibility requirements have driven the uptake of fire-rated ACPs across Germany, France, and the UK. Non-fire-resistant ACPs, while still used in signage and interior applications, are gradually being phased out from high-rise construction. This shift is reshaping value chain optimization, as manufacturers invest in advanced coatings and mineral core technologies to achieve compliance while maintaining cost competitiveness.

Application segmentation underscores the dominance of building and construction, which accounts for the majority of ACP demand. From exterior cladding to interior partitions, ACPs deliver segment-wise performance advantages such as thermal insulation, design flexibility, and reduced structural load. The U.S. Energy Information Administration (EIA) highlights that over 40% of total U.S. energy consumption is attributable to buildings, reinforcing ACPs’ role in reducing heating and cooling loads. Beyond construction, the signage and advertising industry reflects steady growth, with ACPs preferred for durability and printability in outdoor displays. Automotive applications, particularly for interior panels and lightweight body structures, are also expanding as manufacturers pursue product differentiation to improve fuel efficiency.

End-user segmentation reveals commercial and institutional projects leading ACP adoption, with significant investment in malls, airports, and healthcare facilities. Residential projects are increasingly turning to ACPs in urban settings due to affordability and the ability to integrate modern aesthetics. Industrial demand remains modest but is expected to rise as ACPs gain traction in warehouse construction and factory retrofitting projects. Application-specific growth is particularly visible in Asia Pacific, where rapid urbanization has driven segment-wise performance improvements across diverse industries.

Read More @ https://www.polarismarketresearch.com/industry-analysis/aluminum-composite-panel-market

Market dynamics emphasize several drivers, including rapid urbanization, stringent building codes, and the cost advantages of ACPs compared to alternatives like natural stone or steel cladding. Restraints include raw material price volatility and environmental disposal concerns. Opportunities lie in recycling innovations and expanded use in transport infrastructure. Emerging trends include the development of self-cleaning and antimicrobial ACP surfaces, which align with heightened consumer and institutional awareness of hygiene.

Competition is marked by the presence of diversified manufacturers investing in innovation and segment-specific product portfolios. Leading players dominating the global ACP market include:

• 3A Composites

• Mitsubishi Chemical Corporation

• Arconic Corporation

• Alstrong Enterprises India Pvt. Ltd.

• Alucoil

More Trending Latest Reports By Polaris Market Research:

Breast Cancer Therapy Market

Xerostomia Therapeutics Market

Ready-To-Drink Cocktails Market

Hemodynamic Monitoring Devices Market

Interactive Whiteboard Market

Embedded AI Market

LED Packaging Market

Trachoma Treatment Market

Food Service Equipment Market

The aluminum composite panel (ACP) market continues to establish itself as a core material in global construction and manufacturing. Valued at USD 6.53 billion in 2024, the market is expected to expand from USD 7.00 billion in 2025 to USD 13.27 billion by 2034, representing a CAGR of 7.4% during the forecast period. The growth trajectory is closely linked to product differentiation, application-specific growth, and value chain optimization, as stakeholders increasingly assess ACP adoption across diverse market segments. By product type, fire-resistant ACPs represent the fastest-growing segment, reflecting heightened regulatory oversight and safety compliance in both developed and emerging economies. According to the European Commission’s building standards, stricter non-combustibility requirements have driven the uptake of fire-rated ACPs across Germany, France, and the UK. Non-fire-resistant ACPs, while still used in signage and interior applications, are gradually being phased out from high-rise construction. This shift is reshaping value chain optimization, as manufacturers invest in advanced coatings and mineral core technologies to achieve compliance while maintaining cost competitiveness. Application segmentation underscores the dominance of building and construction, which accounts for the majority of ACP demand. From exterior cladding to interior partitions, ACPs deliver segment-wise performance advantages such as thermal insulation, design flexibility, and reduced structural load. The U.S. Energy Information Administration (EIA) highlights that over 40% of total U.S. energy consumption is attributable to buildings, reinforcing ACPs’ role in reducing heating and cooling loads. Beyond construction, the signage and advertising industry reflects steady growth, with ACPs preferred for durability and printability in outdoor displays. Automotive applications, particularly for interior panels and lightweight body structures, are also expanding as manufacturers pursue product differentiation to improve fuel efficiency. End-user segmentation reveals commercial and institutional projects leading ACP adoption, with significant investment in malls, airports, and healthcare facilities. Residential projects are increasingly turning to ACPs in urban settings due to affordability and the ability to integrate modern aesthetics. Industrial demand remains modest but is expected to rise as ACPs gain traction in warehouse construction and factory retrofitting projects. Application-specific growth is particularly visible in Asia Pacific, where rapid urbanization has driven segment-wise performance improvements across diverse industries. Read More @ https://www.polarismarketresearch.com/industry-analysis/aluminum-composite-panel-market Market dynamics emphasize several drivers, including rapid urbanization, stringent building codes, and the cost advantages of ACPs compared to alternatives like natural stone or steel cladding. Restraints include raw material price volatility and environmental disposal concerns. Opportunities lie in recycling innovations and expanded use in transport infrastructure. Emerging trends include the development of self-cleaning and antimicrobial ACP surfaces, which align with heightened consumer and institutional awareness of hygiene. Competition is marked by the presence of diversified manufacturers investing in innovation and segment-specific product portfolios. Leading players dominating the global ACP market include: • 3A Composites • Mitsubishi Chemical Corporation • Arconic Corporation • Alstrong Enterprises India Pvt. Ltd. • Alucoil More Trending Latest Reports By Polaris Market Research: Breast Cancer Therapy Market Xerostomia Therapeutics Market Ready-To-Drink Cocktails Market Hemodynamic Monitoring Devices Market Interactive Whiteboard Market Embedded AI Market LED Packaging Market Trachoma Treatment Market Food Service Equipment Market0 Комментарии ·0 Поделились ·677 Просмотры ·0 предпросмотр

Больше