Cloud Kitchen Market Driven by Rising Demand for Online Food Delivery 2030

Global Cloud Kitchen Market: Transforming the Future of Food Delivery

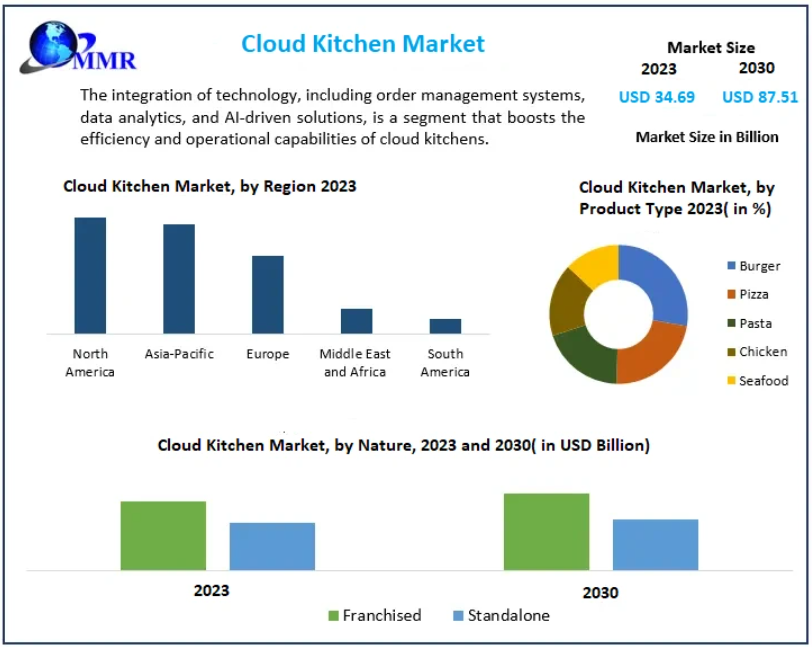

The Global Cloud Kitchen Market, valued at USD 34.69 billion in 2023, is rapidly reshaping the food service industry. Propelled by the rising demand for quick, convenient, and digitally enabled meal options, the market is projected to reach USD 87.51 billion by 2030, expanding at a robust CAGR of 14.13%.

Cloud kitchens—also known as virtual kitchens, ghost kitchens, or dark kitchens—operate exclusively for delivery and takeout. By eliminating dine-in infrastructure and optimizing operations through digital technologies, these kitchens represent one of the most disruptive business models in the global food ecosystem.

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/109430/

Cloud Kitchens: The Digital Backbone of Modern Food Service

At the core of the cloud kitchen phenomenon is a simple idea: why pay for front-of-house when customers prefer delivery?

Unlike traditional restaurants:

- They require no physical dining space

- They operate with lower overhead costs

- They can host multiple brands under one roof

- They leverage technology to optimize every stage of food production and delivery

The shift in consumer behavior—marked by a preference for digital ordering, faster delivery, and variety—has accelerated the adoption of cloud kitchens worldwide.

Market Dynamics Driving Growth

1. Explosive Demand for Food Delivery

With consumers increasingly valuing speed, convenience, and variety, online food delivery has become mainstream.

Platforms such as:

- DoorDash

- Uber Eats

- Zomato

- Swiggy

have built vast ecosystems that directly fuel the cloud kitchen model. For example, Zomato and Swiggy aim to reach 200 million users in India within the next five years—an expansion perfectly aligned with virtual kitchen scalability.

2. Digital Technology Adoption

Cloud kitchens thrive on:

- AI-powered kitchen management systems

- Smart inventory tools

- Data-driven menu engineering

- Real-time customer analytics

These technologies optimize efficiency, reduce food waste, and unlock hyper-personalized delivery experiences.

3. Expanding Opportunities for Restaurateurs

For food entrepreneurs and established restaurant chains, cloud kitchens offer:

- Lower Capex (one-third that of traditional restaurants)

- Rapid scalability across cities

- Flexibility to test new cuisines or brands

- Higher profit margins (typically 20–25%)

Shared and commissary kitchens have become especially popular, allowing multiple brands to operate in a single space, driving efficiency and revenue.

Challenges Restraining Market Growth

Despite rapid expansion, the industry faces hurdles:

- High Initial Setup Costs: Equipment, technology platforms, and commercial kitchen infrastructure involve significant investment.

- Intense Competition: Numerous virtual brands compete for visibility on delivery apps.

- Low Pricing Power: Discount-driven food delivery reduces profitability.

- Customer Trust Issues: Hygiene, authenticity, and transparency concerns impact repeat orders.

- Health Concerns: Frequent consumption of fast food—high in carbs and low in fiber—raises public health implications.

Segmental Insights

By Type

- Independent Cloud Kitchens are expected to grow the fastest.

- Commissary/Shared Kitchens are gaining traction as they offer cost-sharing and flexibility.

- Kitchen Pods are emerging as modular, movable solutions.

By Product

The burger/sandwich segment dominates the market, accounting for 32% of sales in 2023.

Other high-demand categories include:

- Pizza

- Mexican/Asian cuisine

- Chicken-based meals

- Healthy/organic meal-prep menus

By Nature

- Franchised virtual brands are expanding rapidly due to reduced risk, training support, and strong brand reputation.

- Standalone brands thrive by offering unique menus and niche cuisines.

By Deployment

Cloud kitchens rely heavily on:

- Web-based platforms

- Mobile apps, which dominate due to smartphone penetration and mobile payment adoption.

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/109430/

Regional Highlights

North America

A mature market led by the U.S., with robust adoption of digital ordering platforms. Major players like DoorDash, Grubhub, and Uber Eats continue to innovate through cloud kitchen network expansion.

Europe

The continent’s diverse culinary culture creates fertile ground for multi-brand virtual kitchens. Urbanization and consumer demand for convenience drive market growth.

Asia-Pacific

The fastest-growing region due to:

- Massive urban populations

- Rising disposable incomes

- High mobile payment penetration

- Rapidly evolving food-delivery ecosystems

Countries such as China, India, Japan, and South Korea dominate regional cloud kitchen adoption.

Competitive Landscape

Intense competition is pushing operators to differentiate through:

- Unique menus

- Technology-driven efficiency

- Multi-brand strategies

- Sustainable packaging and waste management

Notable Developments

- Auntie Anne's and Cinnabon partnered with Fresh Dining Concepts to expand co-branded delivery outlets in NYC.

- Starbucks advanced its delivery footprint in China via strategic collaboration with Alibaba’s Ele.me platform.

Key players include:

McDonald’s, Domino’s Pizza, CKE Restaurants, Yum Brands, Rebel Foods, Kitchen United, DoorDash Kitchen, Zuul Kitchen, Keatz, Kitopi, and others.

Conclusion: The Future of Food Is Virtual

The Cloud Kitchen Market is redefining the economics and operational structure of the restaurant industry. As consumers continue to embrace digital ordering and delivery services, cloud kitchens will evolve into global culinary powerhouses—leveraging technology, data, and innovation to deliver faster, fresher, and more diverse food experiences.

By 2030, cloud kitchens are expected to account for a significant share of global food delivery revenues, shaping the future of how the world cooks, eats, and orders food.