India Electric Vehicle Components Market Industry Challenges and Risk Mitigation Strategies 2030

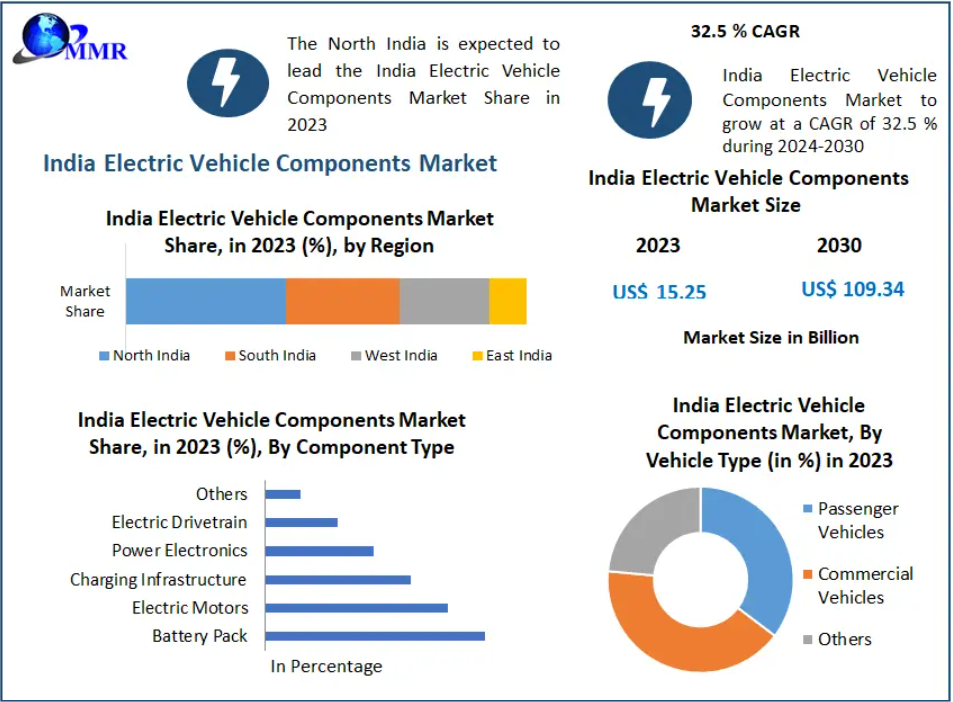

The India Electric Vehicle Components Market, valued at USD 15.25 billion in 2023, is on an exceptional growth trajectory, projected to reach USD 109.34 billion by 2030, expanding at a CAGR of 32.5%. Fueled by technological innovation, rising environmental consciousness, and strong governmental support, the market is transforming India's automotive landscape and catalyzing the shift toward clean mobility.

Market Overview

Electric vehicles (EVs) represent a technological leap in transportation, functioning through a network of sophisticated components that redefine efficiency, sustainability, and performance. At the core lies the Traction Battery Pack, which accounts for 30–40% of the EV’s total cost. India still imports most battery components from China, Japan, and South Korea, but a strong push for domestic manufacturing—including a $5 billion PLI scheme—is driving the establishment of indigenous EV component plants.

Other essential EV components include:

-

DC–DC Converters for power distribution

-

Electric Motors (AC and DC) enabling propulsion and regenerative braking

-

Power Inverters converting DC/AC for motor control and battery charging

-

Power Electronics supporting energy efficiency and thermal management

The interplay of these components determines the overall system performance and cost efficiency of EVs, making components manufacturing a strategic sector for India’s future mobility.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/63133/

Market Dynamics

Driver: Rising Environmental Awareness and Carbon Reduction Mandates

India’s push toward sustainability is a primary catalyst for EV component demand. EVs offer zero tailpipe emissions, essential for combating air pollution in dense cities. The government's aggressive clean energy targets, including 40% non-fossil fuel–based electric power capacity by 2030, significantly support EV adoption.

Additional factors accelerating component demand include:

-

Lower operating costs compared to ICE vehicles

-

FAME incentives, subsidies, and reduced registration fees

-

Declining battery cost trends

-

Enhanced user experience with quieter, smoother rides

This environmental and economic synergy is reshaping consumer preferences, boosting EV sales, and creating a multiplier effect in the components ecosystem.

Trend: Rise of Indigenous EV Component Manufacturing

India is moving toward self-reliance in EV technology under Make in India. The trend is defined by:

-

Growth in local battery manufacturing gigafactories

-

Increased investments in EV R&D

-

Collaborations between OEMs, startups, and technology firms

-

Localization of motors, power electronics, and charging hardware

This shift reduces import dependency, enhances affordability, and creates significant employment opportunities. Indigenous innovation is expected to be the backbone of long-term market expansion.

Restraint: High Initial Costs and Limited Economies of Scale

Despite rapid growth, several challenges persist:

-

High battery costs due to lithium-ion technology

-

Limited manufacturing scale increases per-unit production costs

-

Advanced EV features drive initial vehicle costs higher

-

Heavy reliance on imported components leads to price fluctuations

-

Strong need for extensive charging infrastructure nationwide

Addressing these cost barriers through domestic manufacturing and supply chain localization remains essential for sustained market momentum.

Segment Analysis

By Propulsion Type

Battery Electric Vehicles (BEVs) dominated the market in 2023. Their leadership is supported by:

-

Zero emission advantage

-

Favorable government incentives under FAME and NEMMP

-

Advancements in fast charging and battery energy density

-

Increasing consumer awareness of fuel and maintenance savings

The increasing availability of affordable BEVs will further boost EV component demand across motors, batteries, power electronics, and chargers.

Regional Insights

North India

-

Led by Delhi NCR, Noida, and Gurugram

-

Strong policy incentives and high EV adoption rates

-

Hub for component R&D and manufacturing clusters

South India

-

Karnataka, Tamil Nadu, and Telangana dominate EV innovation

-

Bengaluru houses leading EV startups, R&D centers, and battery labs

-

Chennai and Hyderabad have emerged as component manufacturing hubs

These regions collaboratively shape India’s EV component leadership through industrial strength, technical expertise, and policy-driven expansion.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/63133/

Market Scope

| Details | Description |

|---|---|

| Market Size (2023) | USD 15.25 Bn |

| Market Size (2030) | USD 109.34 Bn |

| CAGR (2024–2030) | 32.5% |

| Segments | Vehicle Type, Propulsion, Components, End-User |

| Key Users | Individuals, Fleet Operators, Government, Commercial Entities |

Key Players

-

SEG Automotive India Pvt. Ltd. – Bengaluru

-

Tata Motors Ltd. – Mumbai

-

Mahindra Electric Mobility Ltd. – Bengaluru

-

Avtec Limited – Delhi

-

Exide Industries Ltd. – Kolkata

-

Bosch Limited – Bengaluru

-

Ashok Leyland – Chennai

-

Maruti Suzuki – New Delhi

-

Okaya Power Pvt. Ltd. – New Delhi

-

Amara Raja Batteries Ltd. – Andhra Pradesh

-

Sparco Batteries Pvt. Ltd. – Pune

-

Eastman Auto & Power Ltd. – New Delhi

-

Exicom Tele-Systems Ltd. – Gurugram

-

Delta Electronics India – Gurugram

-

Hero Electric Vehicles Pvt. Ltd. – New Delhi

These players drive innovation across battery technology, power electronics, motor systems, charging infrastructure, and smart drivetrains.

Conclusion

The India Electric Vehicle Components Market is entering a transformative era. Supported by strong policy frameworks, environmental priorities, technological breakthroughs, and rapid industrialization, the market is set to become one of the fastest-growing EV component hubs globally. As India accelerates toward sustainable mobility, domestic manufacturing, R&D investments, and component innovation will play the pivotal roles in shaping the next generation of electric transportation.