Health Insurance Market: Securing Health in a Digital Age – The Global Transformation of the Health Insurance Market

"Executive Summary Health Insurance Market Size, Share, and Competitive Landscape

CAGR Value

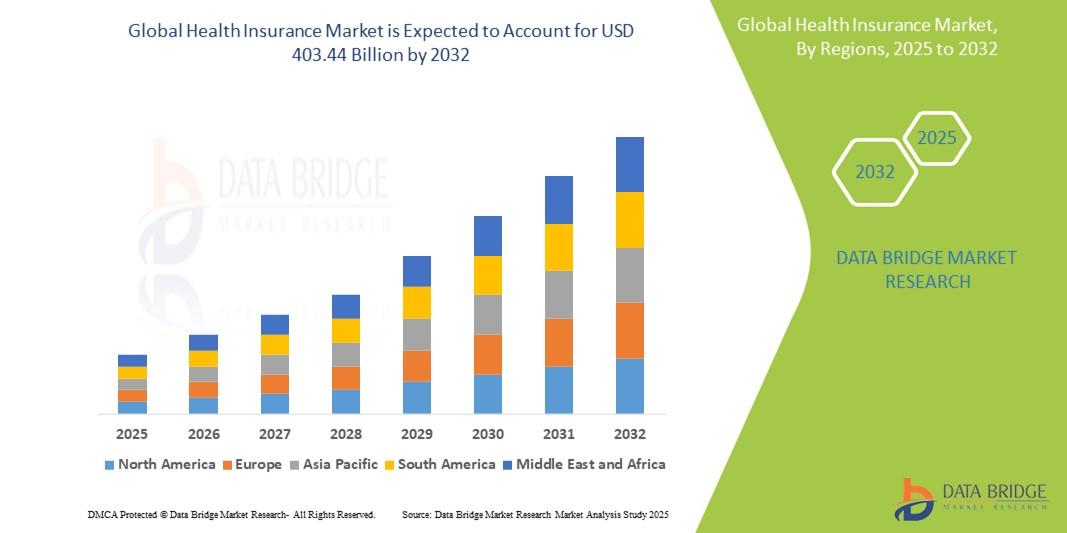

The global health insurance market size was valued at USD 219.58 billion in 2024 and is expected to reach USD 403.44 billion by 2032, at a CAGR of 7.90% during the forecast period

To attain knowhow of market landscape, brand awareness, latest trends, possible future issues, industry trends and customer behavior, the finest Health Insurance Market research report is very crucial. The report also identifies and analyses the intensifying trends along with major drivers, challenges and opportunities in the market. This market report is a source of information about Health Insurance Market industry which puts forth current and upcoming technical and financial details of the industry to 2029. Global Health Insurance Market business report has been formed with the appropriate expertises that utilize established and unswerving tools and techniques such as SWOT analysis and Porter's Five Forces analysis to conduct the research study.

The high quality Health Insurance Market business report encompasses a range of inhibitors as well as driving forces of the market which are analysed in both qualitative and quantitative manner so that readers and users get precise information and insights. All the data and statistics covered in this report are backed up by latest and proven tools and techniques such as SWOT analysis and Porter's Five Forces Analysis. For in depth perceptive of market and competitive landscape, the report serves a lot of parameters and detailed data. The universal Health Insurance Market report is prepared by performing high level market research analysis of key marketplace segments to identify opportunities, challenges, drivers, and market structures for the clients.

See what’s driving the Health Insurance Market forward. Get the full research report:

https://www.databridgemarketresearch.com/reports/global-health-insurance-market

Health Insurance Industry Landscape

Segments

- By Type: The global health insurance market can be segmented into two main types, namely, individual health insurance and group health insurance. Individual health insurance refers to policies purchased by individuals to cover their personal medical expenses. On the other hand, group health insurance is typically provided by employers to cover their employees.

- By Service Provider: This segment includes health insurance policies offered by private health insurance companies, government-sponsored health insurance programs, and social health insurance schemes. Private health insurance companies are profit-driven and offer a wide range of coverage options, while government-sponsored and social health insurance programs are often designed to provide coverage to a specific demographic or population.

- By Coverage Type: Health insurance plans can also be categorized based on the coverage they provide. This includes categories such as medical insurance, disease-specific insurance, income protection insurance, and others. Medical insurance policies are the most common and cover a wide range of medical expenses, while disease-specific insurance policies offer coverage for specific illnesses or conditions.

Market Players

- UnitedHealth Group: UnitedHealth Group is one of the largest health insurance providers globally, offering a wide range of health insurance products and services to individuals and employers. The company has a strong presence in the U.S. market and is known for its innovative insurance solutions and customer-centric approach.

- Anthem Inc.: Anthem Inc. is another key player in the global health insurance market, with a focus on providing affordable and comprehensive health insurance plans to a diverse customer base. The company operates in several markets and is known for its strong network of healthcare providers and quality services.

- Aetna Inc.: Aetna Inc., a subsidiary of CVS Health, is a leading health insurance provider offering a variety of insurance products, including medical, dental, pharmacy, disability, and behavioral health plans. The company is known for its focus on preventive care and wellness programs, aimed at improving the overall health and well-being of its members.

- Cigna Corporation: Cigna Corporation is a global health services organization that offers a range of health insurance and related products and services. The company focuses on enhancing customer experience and improving health outcomes through innovative insurance solutions and integrated care delivery models.

The global health insurance market is experiencing significant growth driven by several key factors influencing the industry landscape. One notable trend is the increasing focus on value-based care and personalized healthcare solutions. Health insurance providers are increasingly emphasizing preventive care, population health management, and wellness programs to improve health outcomes and reduce overall healthcare costs. This shift towards a more holistic and patient-centric approach is reshaping the dynamics of the market and driving the demand for innovative insurance products and services.

Another important trend shaping the global health insurance market is the rise of digital health technologies and telemedicine. The integration of technology into healthcare delivery is revolutionizing the way health services are accessed and delivered, offering new opportunities for insurers to enhance customer experience, improve care coordination, and streamline administrative processes. Telemedicine, in particular, has gained traction as a convenient and cost-effective alternative to traditional in-person consultations, especially in the wake of the COVID-19 pandemic.

Moreover, the growing prevalence of chronic diseases and the aging population are fueling the demand for comprehensive health insurance coverage that addresses the evolving healthcare needs of individuals across different age groups. Insurers are increasingly focusing on developing tailored insurance products that provide coverage for chronic conditions, long-term care, and specialized medical services, catering to the specific requirements of diverse customer segments.

Furthermore, regulatory changes and healthcare reforms in various countries are impacting the competitive landscape of the global health insurance market. Government initiatives to expand healthcare coverage, improve access to care, and enhance insurance affordability are driving market growth and shaping the strategies of industry players. Insurers are navigating evolving regulatory environments, compliance requirements, and market dynamics to capitalize on new opportunities and mitigate risks in a rapidly changing healthcare landscape.

In conclusion, the global health insurance market is witnessing significant transformation driven by trends such as value-based care, digital health technologies, demographic shifts, and regulatory changes. As market players continue to innovate and adapt to the evolving healthcare ecosystem, opportunities for growth, collaboration, and innovation are expected to drive the industry forward. The dynamic nature of the market presents both challenges and opportunities for insurers to differentiate themselves, expand their market presence, and meet the evolving needs of customers in an increasingly complex and competitive landscape.The global health insurance market is a dynamic and rapidly evolving industry driven by various trends and factors shaping its landscape. One key trend influencing the market is the increasing emphasis on value-based care and personalized healthcare solutions. Health insurance providers are shifting towards preventive care, population health management, and wellness programs to enhance health outcomes and reduce healthcare costs. This trend signifies a move towards a more patient-centric approach, which is reshaping the market dynamics and driving the demand for innovative insurance products and services that cater to individual health needs.

Another significant trend impacting the global health insurance market is the integration of digital health technologies and telemedicine. The adoption of technology in healthcare delivery is transforming how health services are accessed and delivered, offering insurers opportunities to enhance customer experience, improve care coordination, and streamline administrative processes. Telemedicine, in particular, has gained popularity as a convenient and cost-effective alternative to traditional in-person consultations, especially in light of the COVID-19 pandemic, driving further innovation and growth in the market.

Moreover, the increasing prevalence of chronic diseases and the aging population are fueling the demand for comprehensive health insurance coverage that addresses the evolving healthcare needs of individuals across different age groups. Insurers are focusing on developing tailored insurance products that provide coverage for chronic conditions, long-term care, and specialized medical services to meet the specific requirements of diverse customer segments.

Furthermore, regulatory changes and healthcare reforms in various countries are shaping the competitive landscape of the global health insurance market. Government initiatives aimed at expanding healthcare coverage, improving access to care, and enhancing insurance affordability are driving market growth and influencing the strategies of industry players. Insurers are navigating evolving regulatory environments, compliance requirements, and market dynamics to capitalize on new opportunities and mitigate risks in a rapidly changing healthcare landscape.

In conclusion, the global health insurance market is witnessing significant transformation driven by trends such as value-based care, digital health technologies, demographic shifts, and regulatory changes. As insurers continue to innovate and adapt to the evolving healthcare ecosystem, opportunities for growth, collaboration, and innovation abound in this complex and competitive market. Adapting to changing customer needs and regulatory environments will be crucial for insurers to differentiate themselves, expand their market presence, and thrive in the evolving landscape of the global health insurance industry.

Review the company’s share in the market landscape

https://www.databridgemarketresearch.com/reports/global-health-insurance-market/companies

Health Insurance Market – Analyst-Ready Question Batches

- What regulatory frameworks govern this Health Insurance Market industry?

- What proportion of sales come from promotions or discounts?

- What is the average shelf life of the Health Insurance Market product?

- How important is personalization in this Health Insurance Market?

- What are the trends in user-generated content for Health Insurance Market?

- What is the average profit margin per unit?

- What’s the demand trend across income groups?

- What portion of sales comes from Tier II & III cities?

- Which retailers dominate product placement?

- What’s the average customer acquisition cost for Health Insurance Market?

- What new market segments are emerging?

- What are the effects of digital transformation?

- Which trends are influenced by Gen Z consumers?

- What are the implications of the circular economy for Health Insurance Market?

Browse More Reports:

Global Paint Stripper Market

Global Pharmaceutical Caps and Closures Market

Global Rolling Stock Management Market

Global Ultrasonic Testing Market

Global Wet-Milling Market

North America Healthcare Information Technology (IT) Market

North America Kyphoplasty Market

Europe Kyphoplasty Market

Asia-Pacific Healthcare Information Technology (IT) Market

Asia-Pacific Kyphoplasty Market

North America X-Ray Detector Market

North America Dental Imaging Market

Europe X-Ray Detector Market

Europe Dental Imaging Market

Asia-Pacific Absorbable and Non-Absorbable Sutures Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"