Bus Market Poised for Strong Growth Through 2032 with 8.5% CAGR

Global Bus Market: Driving the Future of Sustainable Public Transportation

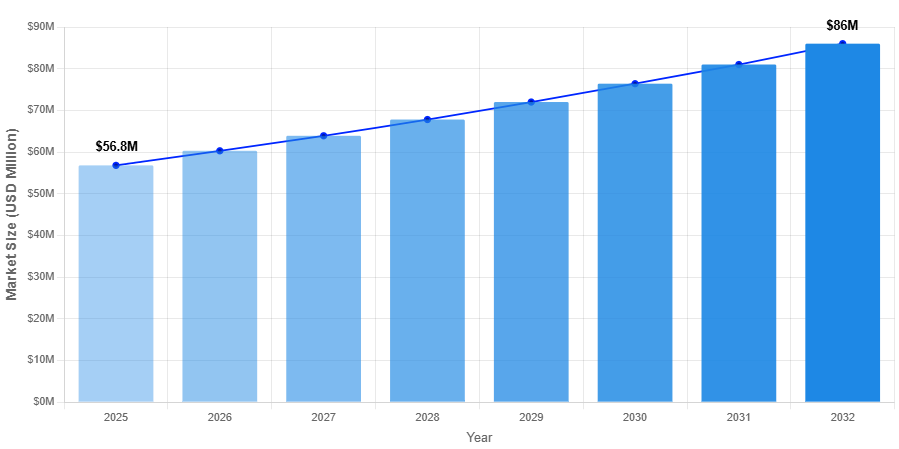

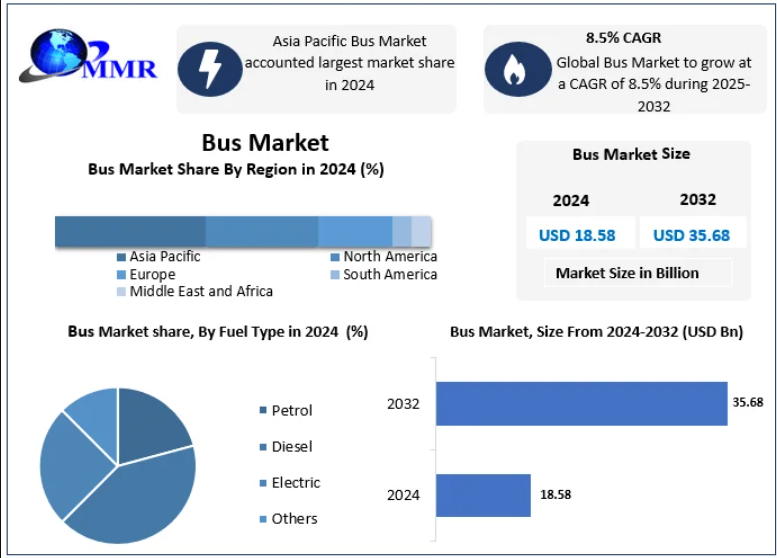

The Bus Market was valued at USD 18.58 billion in 2024 and is projected to reach USD 35.68 billion by 2032, growing at a CAGR of 8.5% during the forecast period (2025–2032). The market’s growth is primarily fueled by rapid urbanization, the increasing need for sustainable mobility, and rising government investments in electric and public transport infrastructure.

Bus Market Overview

The global bus industry plays a crucial role in shaping modern public transportation systems, offering affordable and sustainable mobility solutions. Governments and private operators are increasingly investing in advanced bus technologies—especially electric and hybrid models—to reduce emissions and enhance energy efficiency. Rapid urban population growth, coupled with the demand for reliable public transit, is propelling the expansion of the global bus market.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/211011/

Bus Market Dynamics

1. Increasing Investments in Bus Infrastructure

Investment in bus-based transport is gaining traction as a cost-effective alternative to rail systems. Governments and transportation agencies are expanding bus depots, terminals, and charging networks to support growing fleets.

For example, Proterra secured a USD 200 million investment from Cowen Sustainable Advisors, backed by investors such as Soros Fund Management and Generation Investment Management, to enhance electric bus infrastructure and production.

India’s Sky Bus project in Goa, with a projected USD 11.99 million budget, further demonstrates growing innovation in urban bus systems, complementing similar technologies already deployed in Japan, Germany, China, and the U.S.

2. Rising Adoption of Electric Buses

The electric bus segment is witnessing exponential growth due to global efforts to reduce greenhouse gas emissions and improve urban air quality.

Governments are providing financial incentives, subsidies, and grants to accelerate EV adoption. Electric buses not only offer lower operating and maintenance costs but also reduce noise pollution and tailpipe emissions—improving urban livability.

Leading manufacturers such as BYD, Volvo, and Proterra are investing heavily in electric mobility technologies. In addition, zero-emission buses account for a significant share of new transit fleet orders worldwide.

3. Growing Private Demand for Buses

Beyond public transit, private bus usage is increasing for corporate transportation, tourism, and event management.

Luxury and specialty coaches are in high demand for airport transfers, sports events, and corporate travel, providing convenience and cost savings. For example, NFI Group Inc. reported a backlog of 8,908 buses worth USD 4.9 billion in 2022, with 17% being zero-emission models—highlighting the strong private and institutional interest in modern buses.

4. Challenges: Traffic Congestion and Fuel Volatility

Urban traffic congestion and fluctuating fuel prices remain key restraints. Delays reduce service reliability and discourage public bus use. Additionally, rising fuel costs strain operator profitability, impacting affordability and investment in new fleets. The lack of modern infrastructure in some regions further hampers market growth.

Bus Market Regional Insights

Asia-Pacific (APAC) – Market Leader

Asia-Pacific dominated the global market in 2024, driven by rapid urbanization, population growth, and government-backed emission control initiatives.

China leads the regional market with dominant players like Yutong, BYD, and King Long, supported by extensive domestic demand and EV policies.

India, with manufacturers such as Tata Motors, Ashok Leyland, and Mahindra & Mahindra, is rapidly modernizing its public transport and intercity travel systems. South Korea focuses on fuel-efficient and eco-friendly bus innovations.

Europe – Sustainability-Driven Growth

Europe’s mature transport infrastructure and strict EU emission regulations are accelerating the shift toward electric and hybrid buses.

Countries like Germany, France, and the UK are investing heavily in sustainable fleet modernization. The Euro emission standards and climate commitments are compelling bus manufacturers to design advanced, energy-efficient vehicles.

North America – Rapid Electrification

The North American bus market is expanding rapidly, particularly in the U.S. and Canada, where electric buses are becoming central to urban transit and school systems.

For instance, by 2022, 415 U.S. school districts had committed to deploying over 12,000 electric school buses (ESBs) across 38 states.

Additionally, Greyhound Lines, serving over 2,300 destinations across the U.S., Canada, and Mexico, remains a cornerstone of intercity travel, driving fleet expansion and modernization.

Bus Market Segment Analysis

By Type

-

Transit Bus – Dominated the market in 2024 due to increased public transportation demand and sustainable mobility initiatives.

-

School Bus – Rising adoption of electric and CNG-powered school buses.

-

Coach/Intercity Bus – Growth driven by tourism and long-distance travel demand.

-

Shuttle & Others – Increasing use for private, airport, and event transport.

By Fuel Type

-

Electric Buses – Fastest-growing segment due to cost efficiency and environmental benefits.

-

Diesel and Petrol Buses – Still dominant in developing economies but gradually being replaced by low-emission alternatives.

-

Others (CNG, Hydrogen, Hybrid) – Expected to witness strong adoption in urban transit systems.

By Seating Capacity

-

15–30 Seats: Ideal for short routes and private use.

-

31–50 Seats: Widely adopted in city transit.

-

More than 50 Seats: Preferred for intercity and long-haul routes.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/211011/

Competitive Landscape

The global bus market is highly competitive, with both established and emerging players investing in electrification, automation, and smart connectivity.

Key Companies:

-

Ashok Leyland

-

Tata Motors Limited

-

BYD Company Limited

-

Yutong Bus Co., Ltd.

-

Volvo Group

-

Daimler Truck Holding AG

-

NFI Group Inc.

-

Proterra

-

King Long United Automotive Industry Co. Ltd.

-

VDL Bus & Coach

-

Mahindra & Mahindra

-

Otokar, Temsa, Irizar Group, Solaris Bus, Ebusco, and others.

Recent Developments:

-

Proterra partnered with LG Energy Solutions for advanced lithium-ion batteries.

-

BYD and Castrosua jointly launched their first eBus in Santiago de Compostela in 2023.

-

Volvo Buses collaborated with tech firms to develop autonomous and connected electric buses.

-

FirstGroup announced its acquisition of Ensignbus to strengthen its UK operations.

Conclusion

The global bus market is on a transformative path—driven by electrification, sustainability goals, and increasing public transit investments. Governments and private operators worldwide are shifting toward eco-friendly and smart mobility solutions to reduce congestion, cut emissions, and enhance commuting efficiency.

With strong growth projected through 2032, the sector will play a pivotal role in reshaping urban mobility and advancing the global transition toward a cleaner, smarter, and more connected transportation ecosystem.