High Throughput Screening Market Opportunities in Personalized and Genomic Medicine 2030

Global High Throughput Screening Market – Revolutionizing Drug Discovery Through Automation and Innovation

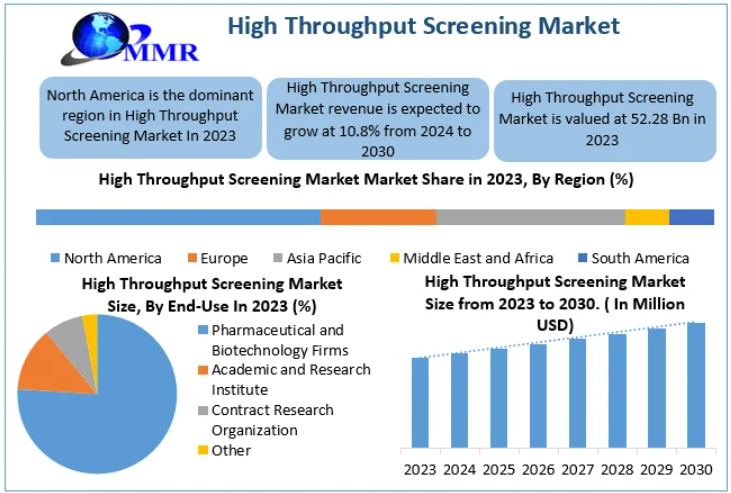

The Global High Throughput Screening (HTS) Market was valued at USD 25.5 billion in 2023 and is projected to grow at a robust CAGR of 10.8% from 2024 to 2030, reaching nearly USD 52.28 billion by 2030. The market’s rapid growth reflects the increasing demand for faster, more efficient drug discovery solutions, as pharmaceutical and biotechnology companies race to develop targeted therapies, biologics, and precision medicines.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/54828/

High Throughput Screening Market Overview

High Throughput Screening (HTS) is a cornerstone technology in modern drug discovery that enables researchers to rapidly analyze thousands to millions of compounds against biological targets using automation, robotics, and advanced data analytics. By integrating robotic liquid handling systems, sensitive detectors, and data management software, HTS accelerates the process of identifying “hit” compounds that can potentially become therapeutic leads.

This approach has revolutionized pharmaceutical R&D, drastically reducing the time and cost required to identify viable drug candidates. The global expansion of biotechnology startups, growing government funding for drug development, and continuous advancements in AI-driven bioinformatics and 3D cell culture technologies are further fueling market growth.

High Throughput Screening Market Dynamics

1. Growing R&D Investments Driving Market Expansion

Pharmaceutical and biotechnology companies are investing heavily in R&D to develop treatments for chronic and rare diseases. The rising global health burden of cancer, cardiovascular disorders, and neurodegenerative diseases has intensified the need for faster, high-precision drug screening methods. HTS allows researchers to conduct large-scale compound screenings within days, significantly accelerating lead discovery and optimization.

Furthermore, supportive government initiatives and venture capital investments are fostering innovation in this space. For example, several U.S. and European funding programs are promoting automation and AI integration in biomedical research, strengthening HTS infrastructure globally.

2. Technological Advancements in Screening and Automation

Recent innovations such as lab-on-a-chip platforms, AI-based predictive analytics, and 3D cell culture models are enhancing the relevance and accuracy of HTS assays. The emergence of label-free technologies and microfluidic systems has improved assay sensitivity and reduced reagent costs.

Automation through robotics and machine learning enables high-throughput data processing, ensuring reliable and reproducible results, while minimizing human error.

3. Rising Adoption in Stem Cell and Toxicology Research

HTS technologies are increasingly being used beyond drug discovery—particularly in stem cell biology, toxicology, and genomics research. They help identify target hits, evaluate cellular functions, and assess the safety of new drug compounds. The ability to integrate human stem cell models has improved clinical predictability and reduced dependence on animal testing, aligning with global trends toward ethical and sustainable research.

4. High Cost and Complexity Restraining Market Growth

Despite its benefits, HTS implementation requires significant investment in infrastructure, reagents, and software. Developing customized assays and maintaining automated instruments such as liquid handlers or flow cytometers can be prohibitively expensive for small research facilities. Additionally, data integration and standardization challenges continue to limit widespread adoption, particularly in emerging economies.

High Throughput Screening Market Segment Analysis

By Technology

-

3D Cell Culture is expected to witness the fastest growth during the forecast period.

These models better replicate in vivo environments, enhancing drug efficacy studies and toxicity assessments. The shift from 2D to 3D cultures aligns with the growing emphasis on precision medicine and predictive modeling. -

Other technologies, such as lab-on-a-chip and ultra-high-throughput screening, are gaining traction due to their compact design and ability to reduce sample volumes while increasing assay efficiency.

By Application

-

Target Identification & Validation dominates the market, followed by Primary and Secondary Screening.

Pharmaceutical companies rely heavily on HTS for early-stage compound validation, which is critical for reducing late-stage drug development failures.

By End User

-

Pharmaceutical and Biotechnology Companies lead the market, driven by the continuous need for innovative therapies and drug repurposing studies.

-

Academic and Government Institutes are expanding their adoption of HTS for genomic research and molecular biology studies through government-backed innovation programs.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/54828/

Regional Insights

North America

North America holds the largest market share due to its advanced healthcare infrastructure, strong presence of pharmaceutical giants, and significant R&D funding. The U.S. continues to lead the global HTS ecosystem with major players such as Thermo Fisher Scientific, Agilent Technologies, and Bio-Rad Laboratories innovating next-generation platforms for molecular screening and bioinformatics integration.

Europe

Europe represents a mature market driven by growing applications in chemical testing and life sciences automation. The EU’s stringent drug safety regulations and government support for biomedical research foster the adoption of HTS in drug safety evaluation and toxicity screening.

Asia Pacific

The Asia Pacific region is emerging as a high-growth hub due to expanding biopharmaceutical sectors in China, Japan, and India. Growing investments in biotech startups, academic research, and contract research organizations (CROs) are enhancing regional capabilities in automated drug discovery.

Competitive Landscape

The global HTS market is highly competitive, with major players focusing on automation, miniaturization, and AI integration to expand screening efficiency. Companies are investing in partnerships, acquisitions, and software innovations to strengthen their market positioning.

Key Players:

-

Agilent Technologies, Inc.

-

Danaher Corporation

-

PerkinElmer, Inc.

-

Thermo Fisher Scientific Inc.

-

Bio-Rad Laboratories, Inc.

-

Tecan Group Ltd.

-

Charles River Laboratories International, Inc.

-

Merck KGaA

-

Aurora Biomed Inc.

-

Beckman Coulter, Inc.

Recent Developments:

-

2021: Bio-Rad introduced automation upgrades to its ZE5 Cell Analyzer, improving scalability for high-throughput flow cytometry.

-

2021: A novel screening approach was developed for liver cancer cells expressing SALL4, demonstrating the potential of HTS in oncology research.

-

2019: Charles River Laboratories acquired Citoxlab, expanding its drug discovery and preclinical testing portfolio.

-

2018: Charles River gained commercial access to AstraZeneca’s HTS infrastructure, enabling collaborative innovation.

Market Outlook

The High Throughput Screening Market is poised for rapid transformation through the integration of AI, big data analytics, and cloud-based automation. As drug pipelines become increasingly complex and personalized, the need for faster, more reliable compound screening will continue to rise. By 2030, HTS is expected to be at the heart of every major pharmaceutical discovery process—ushering in a new era of precision medicine, efficiency, and innovation in global drug development.