Virtual Desktop Infrastructure Market Report, Key Players & Forecast | 2030

Mergers and acquisitions (M&A) have been a powerful and defining force in shaping the modern landscape of the global Virtual Desktop Infrastructure (VDI) market, serving as the primary mechanism through which the industry has consolidated and the leading players have built their comprehensive end-user computing platforms. This M&A activity is not merely financial maneuvering; it represents a series of highly strategic moves by companies to acquire critical technologies, consolidate market share, and adapt to the profound shift from on-premise to cloud-based computing. An analysis of Virtual Desktop Infrastructure Market Mergers & Acquisitions reveals that these transactions have been instrumental in shaping the competitive duopoly that has long defined the market, and are now a key part of the strategic response to the disruption being caused by the public cloud giants. These deals are fundamental to understanding the market's past, present, and future structure.

The strategic rationale behind the consistent M&A activity in the VDI sector is clear and has evolved over time. In the earlier stages of the market, M&A was often used to acquire core enabling technologies. For example, both VMware and Citrix made key acquisitions of companies with innovative display protocol and application virtualization technologies to build out the foundations of their flagship platforms. As the market matured, the focus of M&A shifted towards acquiring complementary "add-on" technologies to create a more complete and valuable suite. This included acquiring companies specializing in user environment management, application layering, and performance monitoring. More recently, the M&A landscape has been dominated by massive, transformational, private equity-led deals. The take-private acquisition of Citrix and its subsequent merger with TIBCO, and the acquisition of VMware by Broadcom, are deals on a completely different scale. The strategic rationale here is to create larger, more diversified software companies with significant recurring revenue streams and to drive operational efficiencies and profitability.

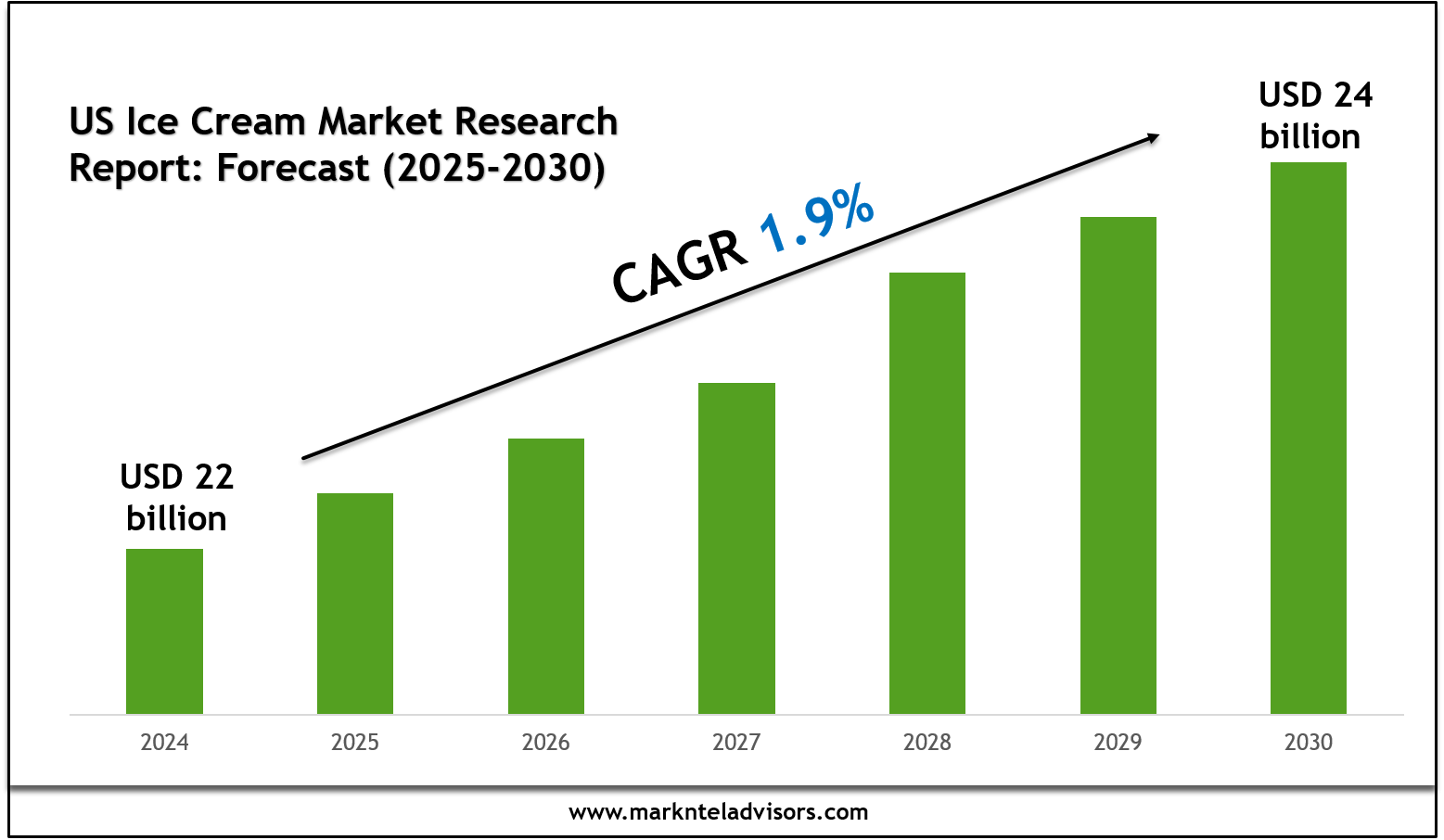

The cumulative impact of this sustained M&A activity is a fundamental and ongoing consolidation of the market into a very small number of massive platform providers. This intensifies the competitive battle between the remaining players and significantly raises the barriers to entry for any potential new challengers. For the enterprise customers of the acquired companies, these large-scale acquisitions create a period of significant uncertainty. They must contend with potential changes in product roadmaps, pricing and licensing models, and the level of customer support and innovation they have come to expect. The Virtual Desktop Infrastructure (VDI) Market size is projected to grow USD 57.8 Billion by 2030, exhibiting a CAGR of 18.20% during the forecast period 2024 - 2030. For the market as a whole, this M&A trend is a clear sign of a mature industry where scale, portfolio breadth, and financial discipline are now as important as pure technological innovation. The M&A narrative will continue to be a central theme as the leaders jockey for position in the new era of hybrid and multi-cloud end-user computing.

Top Trending Reports -

India Communications Interface Market