Global SD-WAN Router Market Insights and Future Outlook | 2035

The SD-WAN router market is a theater of intense and multifaceted competition, fueled by the enormous strategic value enterprises place on their wide-area networks. This rivalry is not just about features and price points; it's a battle of architectural philosophies, business models, and ecosystem strengths. The competitive pressure stems from a diverse set of market participants, including traditional networking hardware vendors, pure-play SD-WAN innovators, formidable cybersecurity companies, and global telecommunications carriers, all converging on the same market opportunity. A deep dive into the SD-WAN Router Market Competition shows that the basis of competition has evolved significantly. In the early days, the primary battleground was cost savings, focused on replacing expensive MPLS circuits with low-cost broadband. Today, while cost remains a factor, the competition has shifted to more sophisticated value propositions, such as application performance optimization, cloud on-ramp capabilities, integrated security, and operational simplification through automation. This evolution has raised the table stakes, forcing vendors to offer comprehensive, feature-rich solutions to remain competitive.

Competitive strategies within the SD-WAN router market are as varied as the players themselves. The incumbent networking giants, like Cisco, compete on the strength of their vast portfolio, deep enterprise relationships, and the promise of a unified architecture spanning the campus, branch, and data center. Their strategy is to provide a secure and familiar migration path for their massive installed base of traditional routers. In stark contrast, many of the pure-play and security-focused vendors compete on agility and innovation. Their strategy often involves leading with a superior, software-defined architecture that is inherently more flexible and easier to manage than the legacy hardware-centric approaches. They also compete fiercely on the strength of their security integrations, championing the concept of a single, converged platform for networking and security at the edge. Another significant competitive dynamic is the rise of managed service offerings. Telcos and MSPs compete not by manufacturing their own routers, but by curating a portfolio of best-of-breed vendor solutions and wrapping them with their own management, monitoring, and professional services. Their competitive advantage lies in their ability to offer a simplified, end-to-end managed solution with a single point of contact and a predictable operational expenditure model.

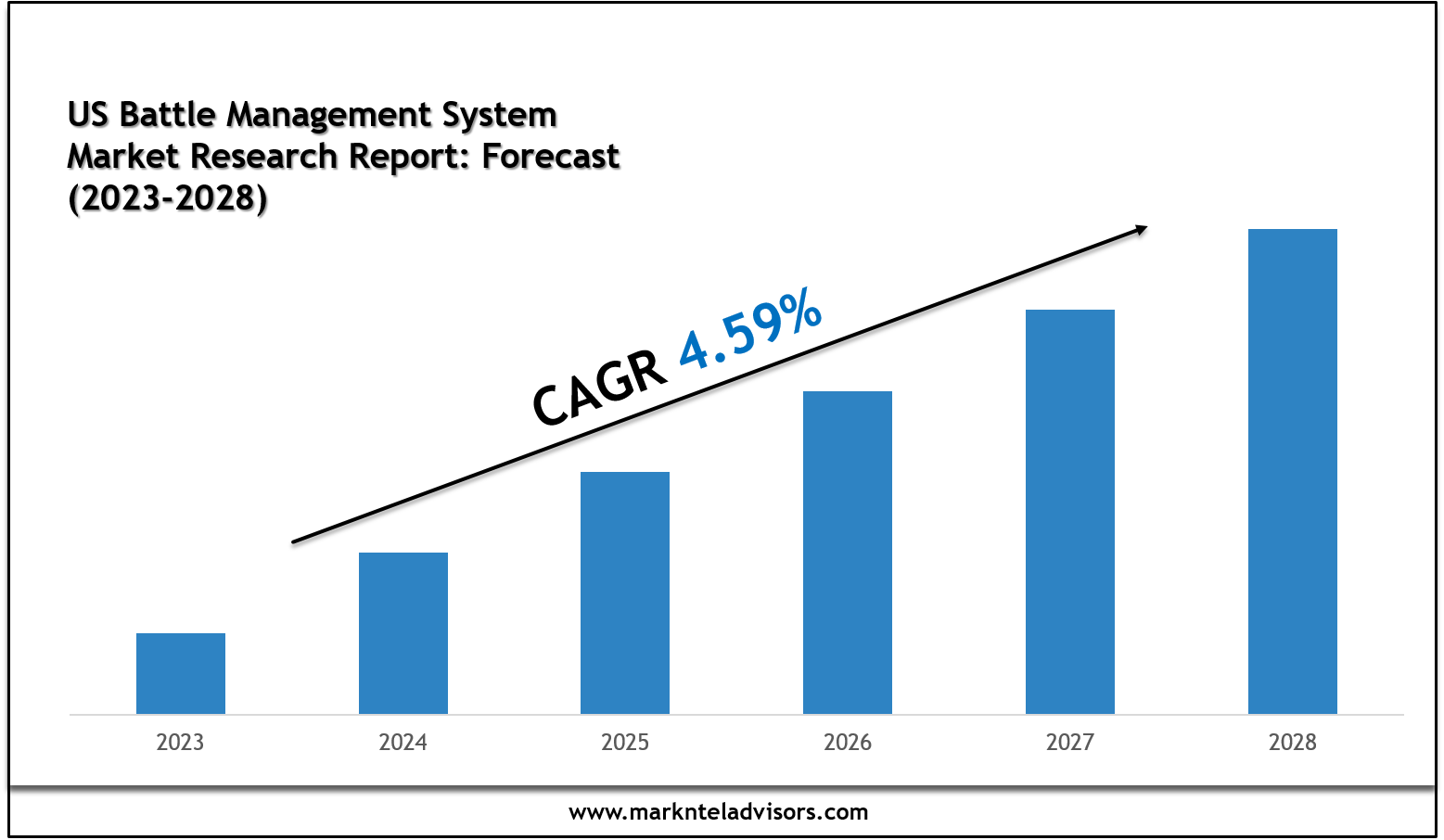

The future of competition in this market will be defined by the ability to deliver a complete, cloud-native Secure Access Service Edge (SASE) platform. The battle is no longer just about the on-premise SD-WAN router; it's about the seamless integration of that edge device with a global network of cloud-based security points of presence (PoPs). This requires massive investment in building out a global cloud footprint, a challenge that will favor the largest and most well-capitalized players. The SD-WAN Router (IPaaS) Market size is projected to grow USD 12.5 Billion by 2035, exhibiting a CAGR of 12.9% during the forecast period 2035. Competition will also intensify around the user experience, both for the end-user (in terms of application performance) and the network administrator (in terms of management simplicity). Vendors who can leverage AIOps to provide a truly "self-driving" network, one that can automatically detect and remediate issues before they impact users, will gain a significant competitive edge. The ultimate winners will be those who can successfully abstract the immense complexity of the modern WAN, delivering a secure, reliable, and automated experience that is simple to deploy and manage.