Bicycle Brake Fluid Market Forecast 2025-2032 | DOT & Mineral Oil Growth Driven by E-Bikes and High-Performance Cycling

Bicycle Brake Fluid Market Analysis 2025-2032

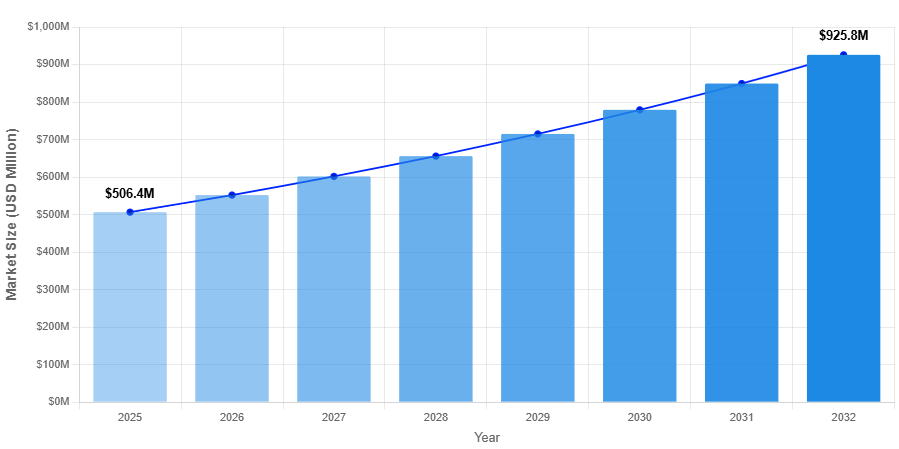

Bicycle brake fluid market is projected to reach USD 282 million by 2032, growing at a CAGR of 4.1% from its 2024 valuation of USD 214 million. This growth reflects the cycling industry’s expansion, particularly in high-performance segments where hydraulic braking systems are essential for safety and performance.

Bicycle brake fluids act as the lifeblood of hydraulic braking systems, transferring force from levers to calipers through incompressible fluids. The market features two main categories: DOT-compliant fluids (meeting Department of Transportation standards) and proprietary mineral oils used in specific systems. As cycling evolves from basic transportation to high-performance sport and recreation, demand for specialized brake fluids increases.

👉 Download FREE Sample Report: Click Here

Market Overview & Regional Analysis

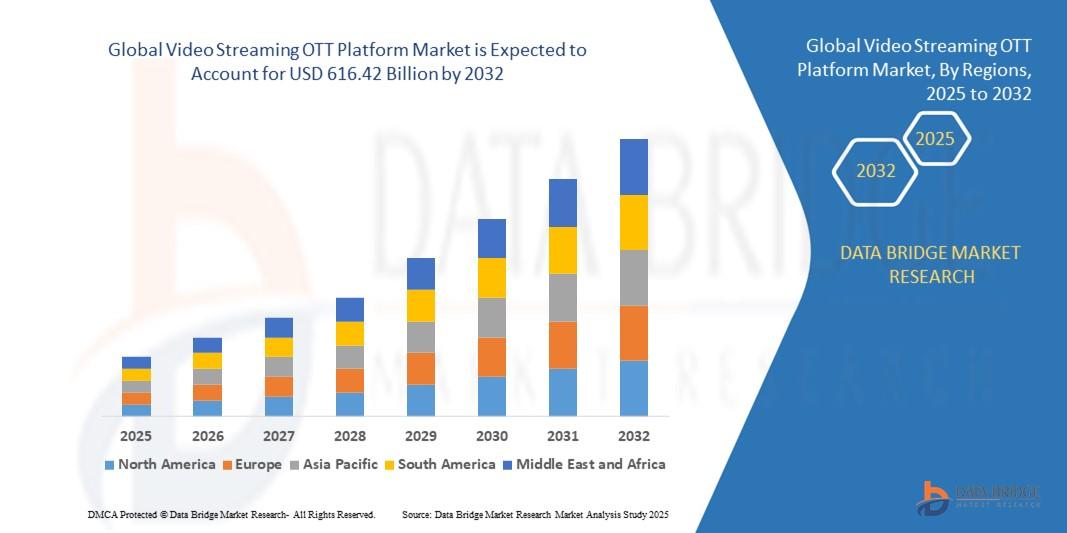

Asia-Pacific dominates bicycle production, but premium brake fluid consumption grows fastest in Europe and North America, where high-performance cycling culture thrives. Japan’s stringent JIS standards ensure quality manufacturing, while European regulations promote environmentally friendly formulations. North America shows strong demand for DOT fluids, accounting for 68% of regional sales, driven by mountain biking popularity and competitive cycling safety requirements.

Annual bicycle sales exceeding 95 million units create a substantial aftermarket for brake fluids. However, adoption varies by region—hydraulic disc brakes now represent 45% of new installations globally, reaching 70% in mountain bikes but remaining lower in entry-level urban bicycles due to cost considerations.

Key Market Drivers and Opportunities

Three primary drivers support market growth: rapid adoption of e-bikes (10–12% annual growth), increasing cyclist safety awareness, and technological advancements in fluid formulations. E-bikes require enhanced brake fluids due to higher weight and speed, creating opportunities for high-temperature and specialized formulations.

Sustainability also presents growth opportunities, as environmentally conscious cyclists pay 8–10% premiums for bio-based fluids. Manufacturers investing in biodegradable mineral oils or less toxic formulations gain competitive advantage, especially in Europe where REACH regulations encourage eco-friendly solutions.

Challenges & Restraints

Market constraints include extended fluid replacement cycles (up to two years for premium fluids) and technical maintenance complexities. Hydraulic systems require specialized knowledge, limiting adoption in regions with underdeveloped bicycle service infrastructure. Brand-specific fluid requirements complicate the landscape—DOT fluids follow automotive standards, while mineral oil formulations differ among Shimano and SRAM.

Environmental regulations also challenge the market, as proper disposal of used brake fluids is increasingly regulated and costly, with some regions experiencing 15–20% higher disposal fees.

Market Segmentation by Type

-

DOT Fluid

-

Mineral Oil

Market Segmentation by Application

-

Road Bikes

-

Mountain Bikes

-

Hybrid Bikes

-

Electric Bikes

-

Others

Key Players

-

Shimano (Japan)

-

SRAM (U.S.)

-

Finish Line (U.S.)

-

Maxima (U.S.)

-

Avid (U.S.)

-

Campagnolo (Italy)

-

Formula Italy (Italy)

-

Spectro Oils (Canada)

-

BunnyHop Tribe (Germany)

-

FSA (U.S.)

-

Hayes (U.S.)

Report Scope

This report provides a comprehensive analysis of bicycle brake fluid market from 2024 to 2032, covering:

-

Market size, revenue forecasts, and growth trends

-

Detailed segmentation by product type and application

-

Regional dynamics and market trends

The study includes in-depth company profiles, detailing:

-

Product portfolios and specifications

-

Production capacities and market shares

-

Financial performance metrics

-

Strategic developments and innovations

Insights are drawn from primary research including:

-

Bicycle brake fluid manufacturers and suppliers

-

Distribution channel partners

-

Industry experts and analysts

👉 Get Full Report Here: Click Here

About 24chemicalresearch

Founded in 2015, 24chemicalresearch is a leading provider of market intelligence for the chemical industry, serving clients including over 30 Fortune 500 companies. We deliver data-driven insights through rigorous research methodologies, addressing government policy, emerging technologies, and competitive landscapes.

-

Plant-level capacity tracking

-

Real-time price monitoring

-

Techno-economic feasibility studies

With over a decade of experience, our dedicated team provides actionable, timely, and high-quality reports to help clients achieve strategic goals.

🌐 Website: www.24chemicalresearch.com

🔗 LinkedIn: 24chemicalresearch