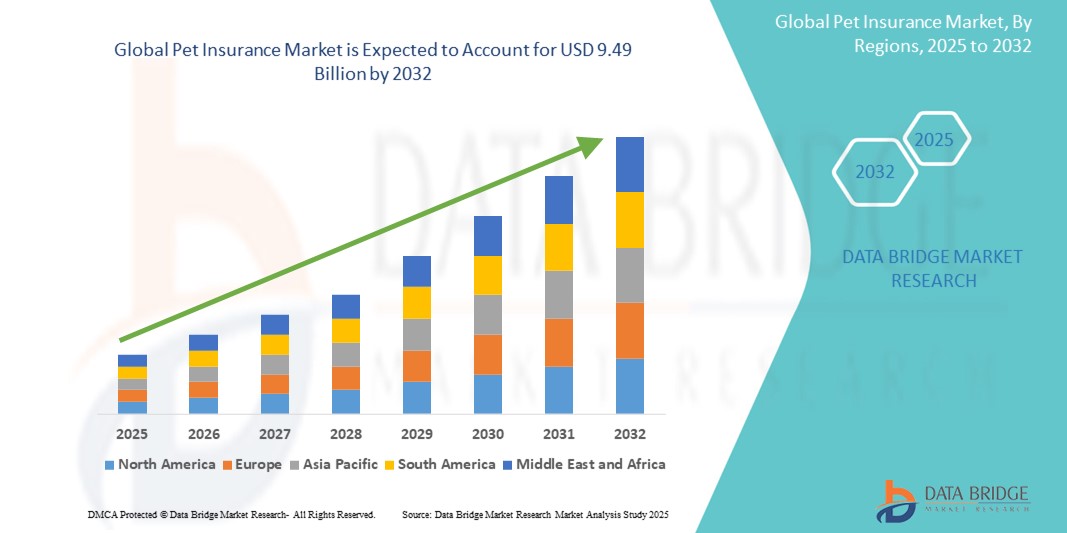

Pet Insurance Market Scope: Growth, Share, Value, Size, and Analysis By 2032

Comprehensive Outlook on Executive Summary Pet Insurance Market Size and Share

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period.

A competitive era calls for businesses to be equipped with acquaintance of the major happenings of the market and Pet Insurance Market industry. Being a valuable market report, Pet Insurance Market report provides industry insights so that businesses indeed don’t neglect anything. It helps achieve an extreme sense of evolving industry movements before competitors. This market research report makes knowledgeable about strategic analysis of mergers, expansions, acquisitions, partnerships, and investment. Pet Insurance Market report explains market definition, currency and pricing, market segmentation, market overview, premium insights, key insights and company profile of the major market players.

A shining team of analysts, experts, statisticians, forecasters and economists work scrupulously to prepare this advanced and all-inclusive Pet Insurance Market research report. The report gives complete knowledge about the market and competitive landscape which aid with better decision making, superior manage marketing of goods and decide market goals for enhanced profitability. With the latest and modernized market insights mentioned in the report, businesses can ponder to enhance their marketing, promotional and sales strategies. Pet Insurance Marketing report also describes strategic profiling of major players in the market, meticulously analyzing their core competencies, and drawing a competitive landscape for the market.

Access expert insights and data-driven projections in our detailed Pet Insurance Market study. Download full report:

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market

Pet Insurance Industry Snapshot

**Segments**

- **Insurance Type**: The pet insurance market can be segmented based on the type of insurance, including accident-only coverage, accident and illness coverage, and comprehensive coverage. Accident-only coverage typically covers unexpected injuries like broken bones or ingested objects. Accident and illness coverage expands on this by adding coverage for illnesses such as cancer or infectious diseases. Comprehensive coverage offers the most extensive protection by combining accident and illness coverage with additional benefits like wellness care.

- **Animal Type**: Another segmentation of the pet insurance market is based on the type of animal being insured. This can include coverage for dogs, cats, birds, exotic pets, and other small animals. Each type of animal may have specific health needs or risks, leading to different insurance options tailored to their requirements.

- **Distribution Channel**: The market can also be segmented by distribution channel, which includes options like direct sales, agency sales, and broker sales. Direct sales involve the insurer selling policies directly to pet owners, while agency sales involve the use of agents to distribute policies. Broker sales rely on brokers who act as intermediaries between pet owners and insurers, helping them find the most suitable coverage.

**Market Players**

- **Trupanion, Inc.**: Trupanion is one of the key players in the global pet insurance market, known for offering customizable policies and a simple claims process. They provide coverage for cats and dogs with various levels of protection to suit different budgets.

- **Healthy Paws Pet Insurance, LLC**: Healthy Paws specializes in providing pet insurance for cats and dogs, focusing on comprehensive coverage for accidents, illnesses, and hereditary conditions. They are known for their quick claim reimbursements and commitment to animal welfare.

- **Petplan Limited**: Petplan offers coverage for dogs, cats, and rabbits, with options for customized policies to meet the specific needs of each pet. They provide coverage for accidents, illnesses, and even dental care, making them a popular choice among pet owners seeking comprehensive protection.

- **Nationwide Mutual Insurance Company**: Nationwide offers pet insurance for a wide range of animals, including exotic pets like birds and reptiles. They provide coverage for accidents, illnesses, preventive care, and even alternative therapies, appealing to pet owners looking for holistic health options for their pets.

The global pet insurance market continues to experience significant growth due to various factors such as the increasing awareness of pet health, rising veterinary costs, and the emotional attachment pet owners have towards their animals. One emerging trend in the market is the integration of technology, with the use of digital platforms and mobile apps for policy management and claims processing. This digital transformation not only enhances customer experience but also streamlines operations for insurance providers. Additionally, there is a growing emphasis on customization and personalization in pet insurance offerings, with insurers providing tailored coverage options to meet the unique needs of different pets and their owners.

Another key development in the pet insurance market is the expansion of coverage to include holistic and alternative therapies for pets. As more pet owners seek natural and holistic treatments for their animals, insurers are starting to include coverage for services such as acupuncture, chiropractic care, and herbal medicine in their policies. This shift towards a more comprehensive approach to pet health reflects the evolving preferences and priorities of pet owners who want the best possible care for their furry companions.

Furthermore, the increasing prevalence of chronic conditions and hereditary diseases in pets is driving demand for insurance coverage that includes these specific health issues. Insurers are responding to this trend by offering specialized policies that cover chronic conditions, genetic disorders, and long-term medical care. By addressing these specific health concerns, insurers can provide peace of mind to pet owners and ensure that their pets receive the necessary treatment without financial constraints.

Moreover, partnerships and collaborations between pet insurance companies and other stakeholders in the pet industry, such as veterinary clinics, pet stores, and animal shelters, are becoming more common. These partnerships not only help insurers reach a wider audience but also enable them to offer value-added services such as discounted veterinary care, nutritional counseling, and preventative health programs. By aligning with key players in the pet ecosystem, insurers can enhance their offerings and create a more holistic approach to pet health and wellness.

In conclusion, the global pet insurance market is undergoing significant transformations driven by technological advancements, changing consumer preferences, and partnerships within the pet industry. These trends are reshaping the landscape of pet insurance and creating new opportunities for insurers to innovate and differentiate their offerings. As the market continues to evolve, we can expect to see further advancements in coverage options, customer engagement, and industry collaborations that cater to the diverse needs of pet owners and their beloved companions.The global pet insurance market is witnessing a significant evolution driven by various factors that are shaping the industry landscape and creating new opportunities for market players. One of the key trends influencing the market is the increasing adoption of technology in insurance processes, such as policy management and claims processing. The integration of digital platforms and mobile apps not only enhances the customer experience but also streamlines operations for insurance providers, leading to improved efficiency and service delivery. This tech-driven approach is likely to continue shaping the market dynamics and set new standards for customer engagement and satisfaction.

Another notable trend in the pet insurance market is the shift towards customization and personalization in insurance offerings. Insurers are increasingly focusing on providing tailored coverage options that meet the unique needs of different pets and their owners. This trend reflects the growing demand for flexible insurance solutions that address specific requirements and preferences, ultimately enhancing the overall value proposition for customers. By offering customizable policies, insurers can better cater to the diverse needs of pet owners and foster long-term relationships based on trust and satisfaction.

Furthermore, the expansion of coverage to include holistic and alternative therapies for pets represents a significant development in the market. As more pet owners seek natural and holistic treatments for their animals, insurers are adapting their offerings to include services like acupuncture, chiropractic care, and herbal medicine. This trend aligns with the evolving preferences of pet owners who prioritize holistic health and wellness for their furry companions. By incorporating these alternative therapies into their policies, insurers can provide comprehensive coverage that resonates with the changing preferences and values of pet owners, thereby enhancing the perceived value of their insurance products.

Additionally, the growing focus on addressing chronic conditions and hereditary diseases in pets is driving demand for specialized insurance coverage. Insurers are responding to this trend by offering policies that cover chronic conditions, genetic disorders, and long-term medical care, providing peace of mind to pet owners and ensuring that their pets receive the necessary treatment without financial constraints. This approach not only reflects the commitment of insurers to pet health and well-being but also creates a competitive edge by addressing specific health concerns that are prevalent among pets.

In conclusion, the global pet insurance market is experiencing a transformation characterized by technological innovation, customization, inclusion of holistic therapies, and specialized coverage for chronic conditions. These trends are reshaping the market landscape and presenting opportunities for insurers to differentiate their offerings and meet the evolving needs of pet owners. By adapting to these market dynamics and embracing innovation, insurers can enhance their competitiveness, drive customer engagement, and create sustainable growth in the dynamic pet insurance industry.

Discover the company’s competitive share in the industry

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market/companies

Market Intelligence Question Sets for Pet Insurance Industry

- What is the total volume of Pet Insurance Market products sold annually?

- How much of the market is dominated by the top 5 players?

- Which country leads in manufacturing Pet Insurance Market products?

- What innovations are disrupting the Pet Insurance Market landscape?

- What is the role of automation in production?

- Which consumer trends are shaping product development?

- How do online vs offline sales compare?

- Which brands are gaining Pet Insurance Market share rapidly?

- What are the economic impacts on this Pet Insurance Market?

- How important is sustainability in purchasing decisions?

- What is the frequency of repeat purchases?

- How are startups disrupting traditional players in the Pet Insurance Market?

- Which certifications influence consumer trust?

- What seasonal trends impact Pet Insurance Market demand?

Browse More Reports:

Global Herbal Tea Market

Global Ready to Drink (RTD) Mocktails Market

Global Cat Litter Market

Global Organo Mineral Fertilizers Market

Global Gift Card Market

Global Non-Alcoholic Wine Market

Global Psychedelic Drugs Market

Europe Gift Card Market

Global Automotive Aftermarket Market

Global Digital Camera Market

Global Fermented Milk Market

Global Fire Protection System Market

Global Industrial Gases Market

Global Plant-Based Oils Market

Global Antenna Market

Global Dual Contaminant Pipe Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com