How to Streamline NetSuite Accounts Receivable Through Outsourcing

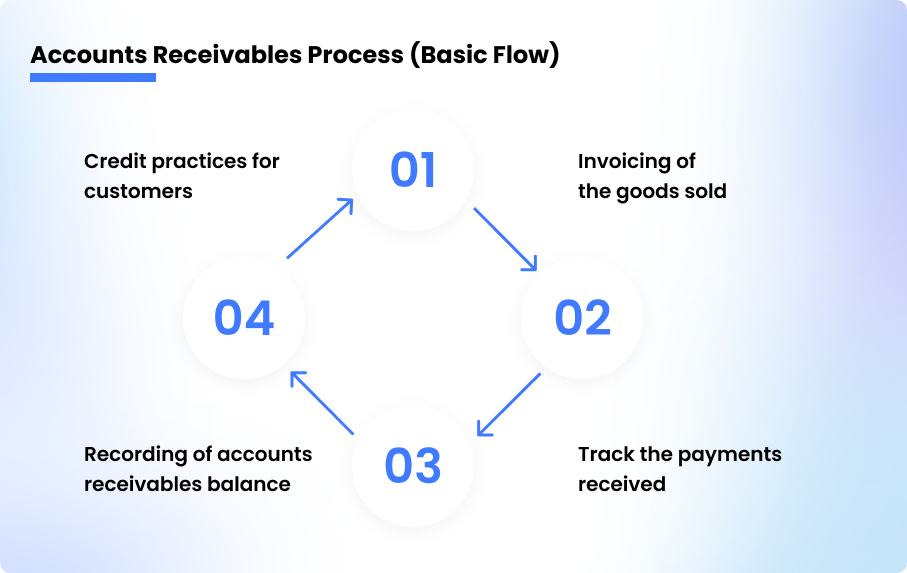

In today’s fast-paced and margin-sensitive business environment, companies are constantly seeking ways to streamline operations, reduce costs, and improve cash flow. One of the most overlooked—but impactful—areas for optimization is accounts receivable (AR). If your business uses NetSuite and is struggling with overdue invoices, delayed payments, or high DSO (Days Sales Outstanding), it might be time to outsource accounts receivable on NetSuite.

Let’s explore why outsourcing AR in a NetSuite environment just makes sense—and how it can transform your financial operations.

1. NetSuite Is Powerful—But AR Still Requires Human Precision

NetSuite is one of the most robust ERP platforms available, offering automation tools, dashboards, and reporting features to manage financial operations. However, AR is not just about processing invoices—it requires timely follow-ups, customer communication, and nuanced collections strategies.

Outsourcing allows you to combine NetSuite’s automation with a dedicated team that specializes in AR processes. This synergy ensures that invoices are not only sent on time, but also followed up on consistently, increasing your chances of getting paid faster.

2. Free Up Internal Resources

Managing AR in-house often requires a dedicated team—or at least a portion of your finance team’s attention. This diverts energy away from higher-value tasks like financial planning, forecasting, or customer experience.

By outsourcing accounts receivable on NetSuite, you free up internal resources to focus on strategic growth, not repetitive AR tasks. Whether it’s reconciling accounts, sending follow-ups, or chasing overdue payments, your outsourced team handles it—efficiently and professionally.

3. Reduce DSO and Improve Cash Flow

Late payments can cripple your cash flow. One of the biggest benefits of AR outsourcing is a measurable reduction in Days Sales Outstanding. Skilled AR professionals use proven tactics to follow up on invoices, resolve disputes, and escalate delinquencies as needed.

With a dedicated outsourcing team integrated into your NetSuite instance, you can expect consistent follow-ups, better payment behavior from customers, and healthier cash flow.

4. Lower Operational Costs

Hiring, training, and managing in-house AR staff can be expensive. Add to that the costs of turnover, software training, and ongoing management—and your internal AR function quickly becomes a significant line item.

When you outsource accounts receivable on NetSuite, you typically pay a predictable monthly fee or a volume-based rate. This makes budgeting easier and reduces overhead, without compromising service quality.

5. Seamless NetSuite Integration

Modern AR outsourcing partners don’t operate in silos—they work directly within your NetSuite environment. This means no duplicate data entry, no exporting/importing files, and no third-party workarounds.

Outsourced AR specialists can access your NetSuite instance (with secure user permissions), manage customer records, send invoices, update payment statuses, and generate reports. Everything remains centralized, accurate, and auditable.

6. Scalable Support During Peak Times

If your business experiences seasonal sales spikes or rapid growth, your AR workload can increase dramatically. Outsourcing gives you the flexibility to scale up or down without hiring or downsizing your team.

Whether you’re dealing with a surge in invoices during the holidays or expanding into new markets, your outsourced AR team can adapt to the volume—without impacting your NetSuite workflows.

7. Improved Customer Relationships

Many businesses worry that outsourcing AR means losing the personal touch. In reality, a good AR partner becomes an extension of your brand. They follow your tone, policies, and preferences when communicating with customers.

With NetSuite as the backbone, outsourced AR teams can personalize their approach using customer history, account notes, and past interactions. This makes collections feel less transactional and more relationship-focused—helping you get paid without alienating customers.

8. Real-Time Reporting and Visibility

One of the biggest advantages of using NetSuite is the real-time visibility it offers across your financial operations. When you outsource accounts receivable on NetSuite, you don’t lose that visibility—in fact, you may gain even more insight.

Outsourcing partners often provide weekly or monthly AR performance reports, customized dashboards, and insights into trends. Since they work directly in NetSuite, you can log in anytime and view the exact same data they’re working from—no lag, no disconnect.

9. Better Compliance and Risk Management

A professional AR outsourcing provider understands the regulatory and compliance landscape. Whether it’s adhering to privacy laws, maintaining audit trails, or handling dispute resolution, they ensure your AR practices are above board.

And because everything is handled in NetSuite, there's a complete record of every invoice, communication, and payment attempt—essential for audits and financial reviews.

10. Quick Implementation and ROI

Implementing outsourced AR with NetSuite is faster than most businesses expect. Because many AR service providers specialize in NetSuite, they already have pre-built workflows, trained staff, and system knowledge to get started quickly.

This means you can start seeing benefits—faster collections, fewer delinquencies, and improved cash flow—within weeks, not months.

Final Thoughts: A Smarter Way to Do AR

NetSuite provides a solid foundation for managing your financial processes, but AR still requires diligence, strategy, and people power. By choosing to outsource accounts receivable on NetSuite, you’re not giving up control—you’re gaining expertise, efficiency, and scalability.

The result? Stronger cash flow, reduced operational burden, and happier customers.

If your business is ready to optimize AR and unlock the full potential of NetSuite, outsourcing might be the smartest move you make this year.