How to Evaluate Accounts Payable Management Services Providers in the US

In today’s competitive environment, U.S. businesses are under constant pressure to cut costs, streamline operations, and remain compliant with evolving regulations. One function that is increasingly being outsourced is accounts payable management services. But why is this trend gaining traction in 2025? Let’s explore how outsourcing AP processes supports efficiency, reduces risks, and enables businesses to focus on growth.

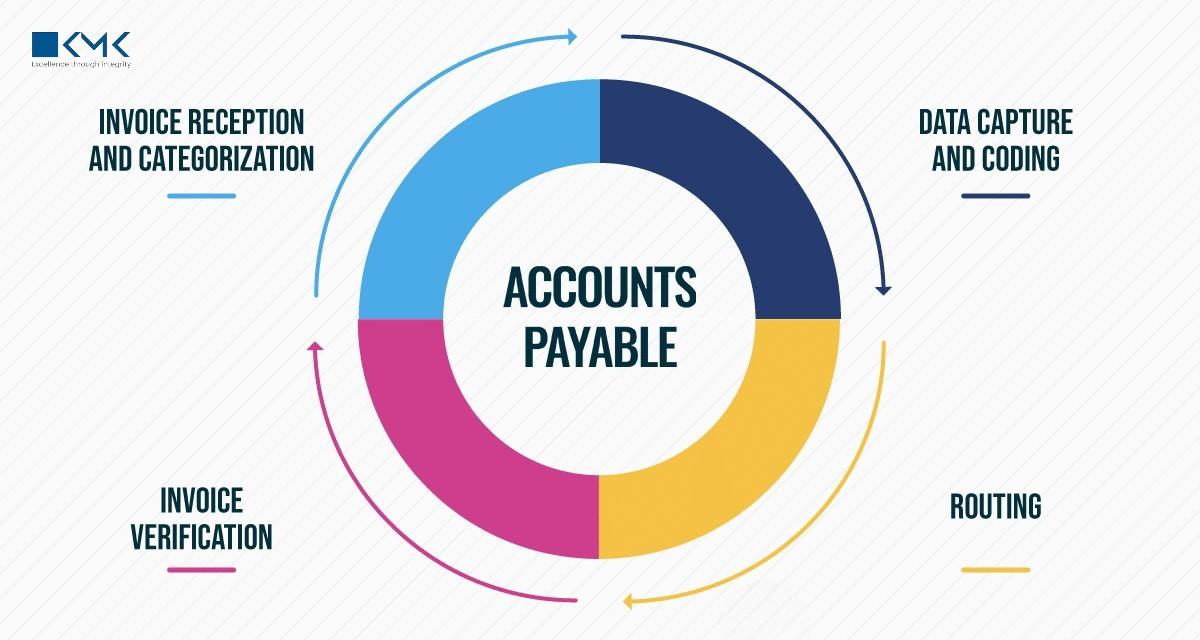

The Growing Importance of Accounts Payable Management

Accounts payable (AP) is more than just paying bills—it’s about ensuring accuracy, maintaining vendor relationships, and keeping cash flow under control. Delayed payments, invoice errors, or missed discounts can have serious financial consequences. That’s where professional accounts payable management services make a difference.

By outsourcing, U.S. companies can access skilled professionals, advanced automation tools, and scalable support without the overhead of maintaining an in-house AP department.

Why Outsourcing Makes Sense in 2025

So, why are U.S. businesses making the shift now more than ever?

-

Cost Savings: Outsourcing reduces overhead by eliminating the need for full-time AP staff, office space, and software investments.

-

Access to Technology: Providers of accounts payable management services use cloud-based platforms, AI, and machine learning to streamline processes.

-

Scalability: Startups and enterprises alike can scale their AP operations up or down without disruption.

-

Compliance Support: With tax and audit regulations becoming stricter, outsourcing ensures businesses stay compliant and audit-ready.

-

Focus on Core Operations: Outsourcing frees up finance teams to work on strategy instead of being bogged down by manual invoice processing.

How Outsourced Accounts Payable Improves Efficiency

One of the key advantages of outsourcing is the ability to eliminate inefficiencies. Manual invoice processing is time-consuming and error-prone. Outsourced providers use:

-

Invoice automation to reduce errors and accelerate approvals.

-

Digital workflows for real-time visibility and faster payment cycles.

-

Vendor portals that improve supplier communication and strengthen relationships.

These improvements not only reduce processing time but also allow businesses to capture early payment discounts and avoid late fees.

Outsourcing and Compliance in 2025

Tax laws, audit requirements, and reporting standards in the U.S. continue to evolve. Non-compliance can lead to penalties, reputational damage, and financial loss.

Outsourced accounts payable management services bring in compliance experts who stay updated with the latest regulations. Providers ensure proper documentation, audit trails, and adherence to GAAP standards—reducing the risk of costly mistakes.

Accounts Payable Outsourcing for Startups vs. Enterprises

Outsourcing isn’t just for large corporations. In 2025, even startups and mid-sized businesses are leveraging AP outsourcing.

-

For Startups: It reduces hiring costs, provides access to experienced professionals, and ensures smooth cash flow management without large overheads.

-

For Enterprises: It helps manage high transaction volumes, improves fraud detection through AI-powered monitoring, and ensures vendor satisfaction at scale.

This flexibility makes accounts payable management services a practical solution for companies of all sizes.

Key Benefits Businesses Are Experiencing

Companies outsourcing AP in 2025 are seeing measurable improvements. Some of the most cited benefits include:

-

50–70% reduction in invoice processing costs

-

Faster approval cycles with automated workflows

-

Improved vendor relationships due to timely payments

-

Better cash flow visibility through centralized dashboards

-

Reduced fraud risks thanks to built-in checks and controls

These results explain why more U.S. businesses are turning to outsourcing for their AP needs.

What to Look for in an Outsourcing Partner

If you’re considering outsourcing AP, choosing the right partner is crucial. Here’s what U.S. businesses should evaluate:

-

Technology stack – Do they offer AI, cloud platforms, and digital workflows?

-

Compliance expertise – Are they updated with U.S. tax and audit regulations?

-

Scalability – Can they handle your company’s growth or seasonal fluctuations?

-

Security standards – How do they ensure data protection and fraud prevention?

-

Client support – Is there a dedicated team available for issue resolution?

A reliable partner ensures seamless integration with your existing systems and aligns with your company’s long-term financial strategy.

The Future of Accounts Payable Outsourcing

In 2025, the combination of automation, artificial intelligence, and professional outsourcing is redefining how businesses manage payables. The shift isn’t just about cost savings—it’s about agility, accuracy, and positioning companies for growth. Outsourcing partners are evolving into strategic advisors, helping businesses optimize working capital, improve compliance, and even strengthen vendor relationships. For U.S. businesses, this means less time on paperwork and more time on innovation and expansion.

Final Thoughts

Outsourcing accounts payable management services is no longer just a cost-cutting tactic—it’s a smart strategic decision. In 2025, U.S. companies are realizing that AP outsourcing provides the perfect balance of efficiency, compliance, and financial insight. By leveraging expert providers and advanced automation, businesses can streamline operations, stay compliant, and unlock growth opportunities. For startups and enterprises alike, outsourcing AP is a game-changer—and that’s why it’s becoming the go-to strategy for forward-thinking U.S. businesses.