Cloud Kitchen Market Regional Analysis and Global Forecast 2030

Global Cloud Kitchen Market: Growth Drivers, Trends, and Strategic Outlook

Market Size and Forecast

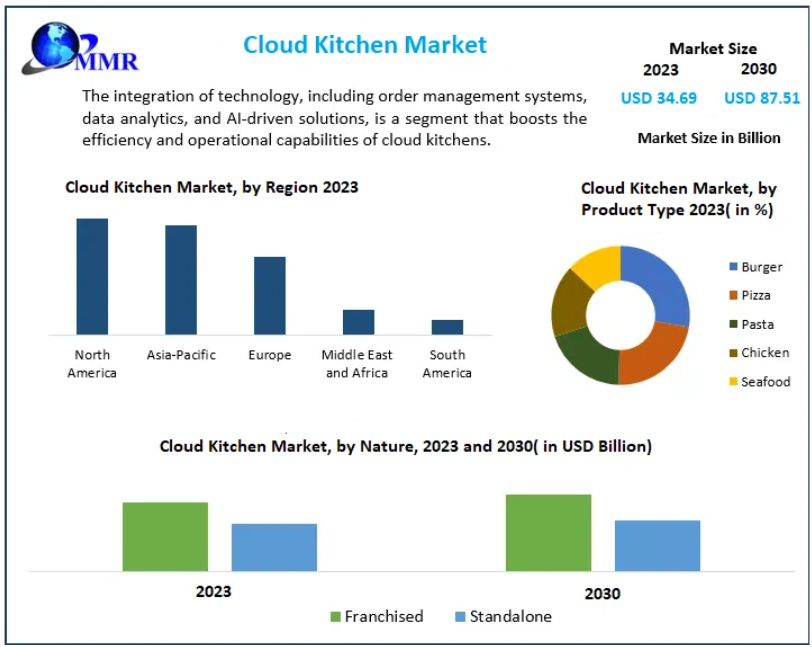

The Global Cloud Kitchen Market was valued at USD 34.69 billion in 2023 and is projected to grow at a strong CAGR of 14.13% from 2024 to 2030, reaching approximately USD 87.51 billion by 2030. This rapid expansion reflects a fundamental shift in the global food service industry toward delivery-first, technology-enabled dining models.

Cloud Kitchen Market Overview

A cloud kitchen, also referred to as a virtual kitchen or ghost kitchen, is a commercial food preparation facility designed exclusively for delivery and takeaway orders, without a dine-in component. These kitchens provide infrastructure, technology, and operational support to food businesses, enabling them to operate efficiently without the costs associated with traditional restaurants.

The rising preference for quick, convenient, and digitally accessible meal options is a key factor driving the adoption of cloud kitchens worldwide. Increased reliance on food delivery platforms has reshaped consumer dining behavior, making cloud kitchens an attractive and scalable business model for both startups and established restaurant brands.

One of the core advantages of cloud kitchens is their low operational overhead. By eliminating dining spaces, décor, and front-of-house staff, operators significantly reduce expenses related to rent, utilities, and maintenance. Many cloud kitchens also support multiple virtual brands under a single roof, allowing businesses to cater to diverse culinary preferences from one centralized location—particularly beneficial in densely populated urban areas.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/109430/

Technology Integration and Market Evolution

Technology plays a pivotal role in shaping the cloud kitchen ecosystem. The adoption of artificial intelligence (AI), data analytics, and kitchen management software has enabled operators to streamline workflows, reduce costs, and improve customer satisfaction.

Advanced analytics tools allow cloud kitchens to monitor customer behavior, identify popular menu items, optimize pricing strategies, and forecast demand. These data-driven insights enhance decision-making and support rapid adaptation to changing market trends. Overall, technology integration has emerged as a major enabler of operational efficiency and sustainable growth in the cloud kitchen market.

Cloud Kitchen Market Dynamics

Rising Demand for Food Delivery Services

The growing demand for food delivery services is one of the most influential drivers of the cloud kitchen market. Urbanization, busy lifestyles, and the desire for hassle-free dining options have accelerated the shift toward online food ordering.

Increased smartphone penetration, improved internet connectivity, digital payment adoption, and efficient logistics networks have further fueled this trend. According to industry analysis, Indian food delivery platforms such as Zomato and Swiggy aim to reach 200 million users over the next five years, with more than 83 million monthly active users recorded in 2023. This rapid expansion of delivery platforms continues to create new opportunities for cloud kitchen operators.

Adoption of Digital Technologies

Digital transformation has significantly altered food ordering, preparation, and delivery processes. Cloud kitchens rely heavily on online ordering platforms, mobile applications, and integrated POS systems, enabling seamless order management and real-time tracking.

Compared to traditional dine-in restaurants, cloud kitchens require substantially lower capital expenditure (Capex). In many cases, setting up a cloud kitchen costs nearly one-third of a conventional restaurant, as investments are focused on kitchen infrastructure, technology, supply chain management, and workforce training rather than expensive real estate and interiors.

Opportunities in the Cloud Kitchen Market

Cloud kitchens present significant growth opportunities due to their cost efficiency, scalability, and operational flexibility. Without the constraints of physical dining spaces, operators can experiment with menus, test new food concepts, and respond quickly to changing consumer preferences.

Restaurant owners increasingly use cloud kitchens to analyze customer data and refine menu offerings, replacing low-margin items with more profitable alternatives. Ghost kitchens are particularly attractive for launching new brands or cuisines, as they allow operators to test concepts with minimal financial risk.

Additionally, cloud kitchens offer higher profit margins, typically ranging between 20% and 25%, and enable faster expansion across multiple locations. In markets such as India, initial investments for a cloud kitchen generally range between INR 7–8 lakhs, depending on scale, location, cuisine type, and technology adoption.

Market Restraints

Despite strong growth potential, the cloud kitchen market faces several challenges. High initial setup costs, intense competition, and thin profit margins can limit entry for smaller players. Infrastructure investments such as commercial kitchen space, equipment, ventilation systems, and safety compliance contribute to upfront costs.

Operational challenges include inventory management, quality control, hygiene standards, workforce monitoring, and limited pricing power due to platform dependency. Additionally, the dominance of fast food offerings raises health concerns, as many items are high in carbohydrates and low in fiber, potentially increasing risks related to obesity, diabetes, and other lifestyle diseases.

Cloud Kitchen Market Segment Analysis

By Type

The Independent Cloud Kitchen segment is expected to grow at the fastest rate during the forecast period. These kitchens primarily depend on third-party delivery platforms and typically focus on specific cuisines or food categories. The rising demand for fast food, international cuisines, and online ordering supports this segment’s expansion.

The growing popularity of commissary and shared kitchens has also led to increased adoption among restaurateurs, caterers, and food trucks, who benefit from shared infrastructure and reduced operating costs.

By Product

Product-focused cloud kitchens enable targeted branding and personalized customer experiences. In 2023, the burger and sandwich segment accounted for approximately 32% of total market revenue, driven by strong consumer demand for convenient fast-food options.

At the same time, health-conscious offerings such as salads, smoothies, and low-calorie meals are gaining traction as consumers increasingly prioritize nutrition and wellness.

By Nature

The franchised cloud kitchen model is witnessing growing adoption due to reduced business risk, established brand recognition, and operational support from franchisors. Franchise operators benefit from training, marketing assistance, supply chain access, and standardized processes.

Standalone cloud kitchens, on the other hand, offer greater flexibility and innovation potential, particularly for niche and experimental food concepts.

By Deployment Type

Deployment models in the cloud kitchen market are shaped by digital accessibility. Web-based platforms and mobile applications play a central role in enabling online food ordering, payment processing, and delivery tracking.

Mobile deployment is especially important, catering to the on-the-go lifestyle of modern consumers and supporting seamless customer engagement through intuitive app interfaces.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/109430/

Regional Insights

North America

North America, led by the United States, represents a mature cloud kitchen market supported by a tech-savvy consumer base and widespread adoption of food delivery platforms. Companies such as DoorDash, Uber Eats, Grubhub, and Postmates dominate the region, collectively serving millions of daily users and driving market expansion.

Europe

Europe’s diverse culinary heritage offers strong opportunities for cloud kitchen operators. Urbanization, changing lifestyles, and rising demand for food delivery services are key growth drivers. Cloud kitchens in major European cities benefit from their ability to offer localized and international cuisines tailored to regional tastes.

Asia-Pacific

The Asia-Pacific region is witnessing rapid growth due to urbanization, digital transformation, mobile payment adoption, and evolving consumer preferences. Countries such as China, India, Indonesia, and South Korea are emerging as major cloud kitchen hubs. Restaurateurs in the region increasingly use cloud kitchens to test new menu concepts and scale operations quickly.

Competitive Landscape

The cloud kitchen market is highly competitive, encouraging continuous innovation in menu design, branding, and customer engagement. Operators differentiate themselves through unique culinary concepts, dietary-specific offerings, and technology-driven efficiency.

Strategic partnerships have become a key growth strategy. For instance, Auntie Anne’s and Cinnabon partnered with Fresh Dining Concepts to expand co-branded cloud kitchen locations in New York City, while Starbucks collaborated with Alibaba’s Ele.me to strengthen its delivery presence in China.

Key Players in the Global Cloud Kitchen Market

Major players shaping the market include Domino’s Pizza, McDonald’s, Yum Brands, Restaurant Brands International, Rebel Foods, Kitchen United, Kitopi, Zuul Kitchen, DoorDash Kitchens, Starbucks, Inspire Brands, and Keatz, among others.

Conclusion

The global cloud kitchen market is transforming the food service industry by offering a cost-efficient, scalable, and technology-driven alternative to traditional restaurants. Driven by rising food delivery demand, digital innovation, and evolving consumer lifestyles, cloud kitchens are poised for sustained growth across developed and emerging markets. As competition intensifies, success will increasingly depend on operational efficiency, brand differentiation, and strategic use of technology.