Latin America Mobile Gaming Market Trends, Forecast, Growth and Share Report 2025-2033

Market Overview

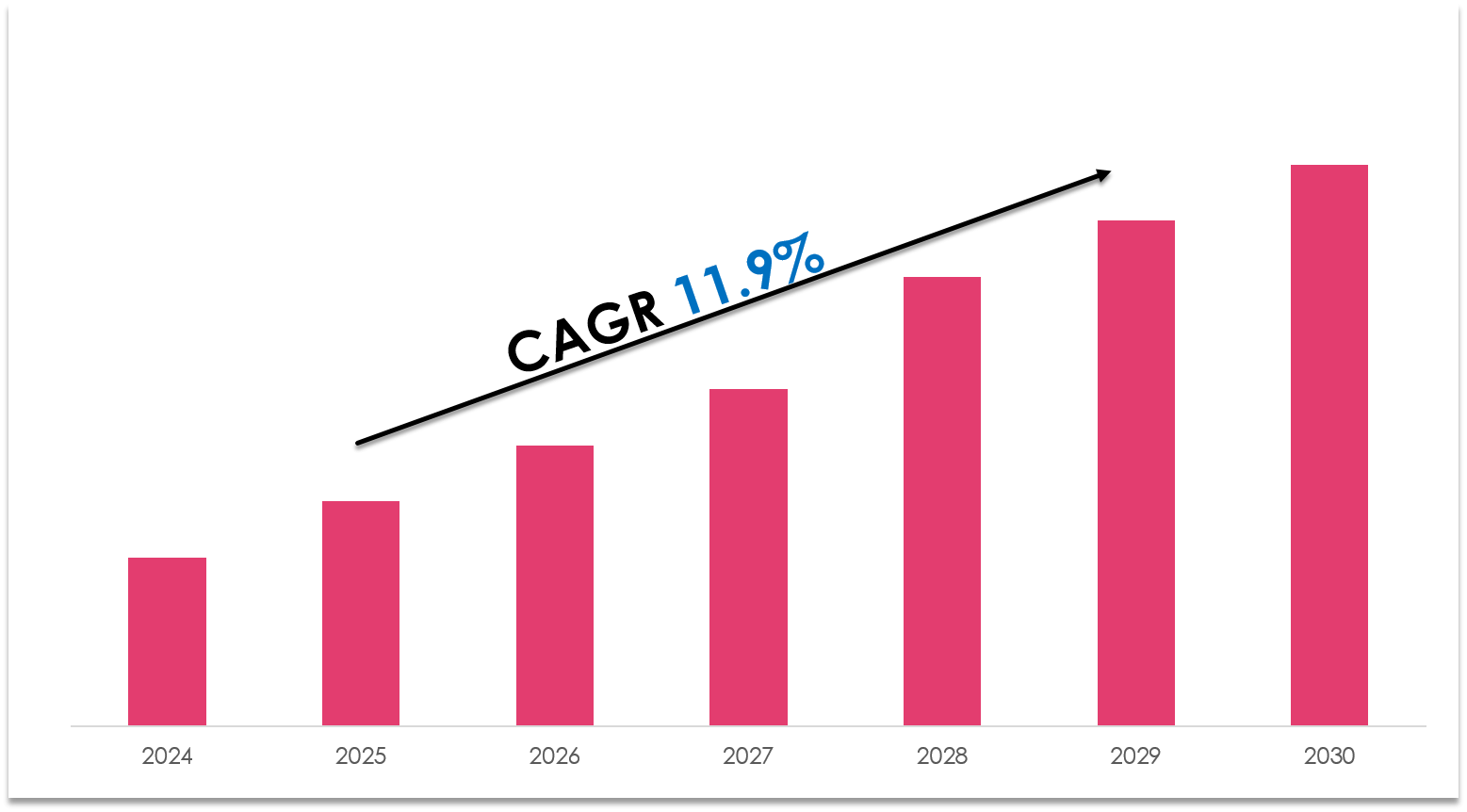

The Latin America mobile gaming market size reached USD 6.81 Billion in 2024. The market is forecasted to reach USD 15.41 Billion by 2033, growing at a CAGR of 8.80% during the forecast period of 2025 to 2033. Increasing internet connectivity improvements, growth in mobile eSports, and the rise of cloud gaming platforms that allow resource-intensive games on lower-spec devices are driving this growth.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Latin America Mobile Gaming Market Key Takeaways

- In 2024, the market size was USD 6.81 Billion.

- The market is expected to exhibit a CAGR of 8.80% between 2025 and 2033.

- The forecast period spans from 2025 to 2033.

- Rapid smartphone penetration and improved internet infrastructure, particularly 4G and 5G rollout in countries like Brazil and Mexico, are key growth factors.

- Mobile eSports is evolving into a mainstream entertainment segment in the region with increasing community engagement.

- Cloud gaming platforms are removing hardware barriers, enabling play on budget smartphones and older devices.

- The adoption of cloud computing is significant, with 80% of companies in Latin America having reached cloud adoption status.

Sample Request Link: https://www.imarcgroup.com/latin-america-mobile-gaming-market/requestsample

Market Growth Factors

Improved internet connectivity is a pivotal driver of the Latin America mobile gaming market. Investments in 4G and emerging 5G networks are expanding regional internet access, increasing download speeds, and reducing latency, which are vital for multiplayer and cloud-based gaming experiences. Brazil and Mexico are notable for significant 5G rollouts, enhancing mobile gaming appeal. Additionally, the proliferation of affordable smartphones has broadened the user base, with 418 million people in Latin America using mobile internet by the end of 2023, according to GSMA.

Mobile eSports is rapidly gaining traction in Latin America and significantly contributes to the growth of the market. Competitive gaming has transitioned from niche communities to mainstream entertainment, supported by organized eSports groups, sponsorships, and high-profile mobile game releases. For instance, Pragmatic Play launched social tournaments in 2024, combining gamification and social interaction to engage players continent-wide in free online slot tournaments. Streaming platforms further enhance mobile eSports by enabling real-time community engagement, strategy sharing, and competition, driving player retention and attracting new participants.

Cloud gaming is revolutionizing mobile gaming in Latin America by eliminating hardware limitations. This technology allows users to play sophisticated games via remote servers on low-spec devices, widening accessibility where budget devices are prevalent. Tech giants and major gaming companies are expanding cloud gaming offerings, leveraging existing 4G and newly deployed 5G infrastructure to offer seamless gameplay and high-quality graphics. Furthermore, the adoption of cloud computing, with 80% cloud penetration in Latin American companies as reported by NTT Data, supports the market's expansion and technological advancement.

Market Segmentation

Type:

- Action or Adventure: Includes games focused on dynamic gameplay involving exploration and combat.

- Casino: Covers gambling-style games adapted for mobile platforms.

- Sports and Role Playing: Encompasses sports simulations and games where players assume roles.

- Strategy and Brain: Includes games requiring tactical thinking and problem-solving skills.

Device Type:

- Smartphone: Dominant device supporting the majority of mobile gaming activities.

- Smartwatch: Gaming on wearable devices.

- PDA: Personal digital assistants used as gaming devices.

- Tablet: Larger screen mobile devices used for games.

- Others: Includes additional mobile devices not categorized above.

Platform:

- Android: The primary operating system for most mobile games in the region.

- iOS: Apple's operating system supporting a subset of mobile games.

- Others: Other lesser-used platforms in the market.

Business Model:

- Freemium: Games offered for free with optional paid content.

- Paid: Games sold for a one-time purchase price.

- Free: Games that are entirely free to play.

- Paymium: Combination of paid game with in-game purchases.

Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Regional Insights

Brazil and Mexico are key markets benefiting from the rollout of 5G services, enhancing mobile gaming experiences through increased download speeds and reduced latency. The penetration of mobile internet reached 418 million users by the end of 2023 in Latin America, supporting the growing mobile gaming ecosystem. This infrastructure growth and user base expansion position Latin America for robust market growth.

Recent Developments & News

In August 2024, Google introduced the third version of its Indie Games Fund, providing $2 million to selected autonomous creators and studios in Latin America, along with practical support to small gaming studios. Also, in August 2024, India’s WinZo announced its expansion into Brazil and signed an agreement with the São Paulo School of Business Administration at Fundação Getulio Vargas (FGV Eaesp) to recruit students and alumni for product management and research roles.

Key Players

- Pragmatic Play

- WinZo

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.