China Aviation MRO Logistics Market Growth Momentum: Supply Chain Innovation and Efficiency Trends

The China Aviation MRO Logistics Market is becoming a critical pillar in the country’s rapidly evolving aviation ecosystem. As China expands commercial air travel, accelerates airport modernization, and strengthens aerospace manufacturing, the need for reliable and highly efficient MRO logistics has grown significantly. The market size continues to rise in parallel with the increasing volume of aircraft maintenance activities, making logistics performance a core operational requirement across airlines and service providers. With aircraft utilization rates climbing and flight frequencies returning to pre-pandemic levels, the country faces heightened demand for time-sensitive parts movement, component repair logistics, and predictive maintenance planning.

Key market trends highlight the rising importance of automation, robotics, and AI-driven supply chain visibility. China’s aviation logistics providers are deploying real-time tracking systems, smart sensors, advanced warehouses, and digital documentation platforms. The adoption of blockchain for parts certification and digital MRO records is also gaining traction. These innovations support seamless coordination among MRO centers, airports, OEM suppliers, and airline engineering teams. As a result, logistics cycles are shortening, spare-parts availability is improving, and aircraft turnaround times are becoming more predictable.

Another major factor contributing to market growth is China’s strategic aviation expansion. With the country set to host one of the world’s largest commercial fleets, the demand for engine, airframe, and component maintenance has surged. Domestic airlines rely on robust supply chains to maintain serviceability and comply with safety regulations. The increase in domestic and international routes has further strengthened the need for efficient MRO logistics networks that can support distributed fleets across multiple hubs. Additionally, China’s growing involvement in aerospace manufacturing has led to deeper integration between production logistics and operational MRO logistics, enhancing overall supply efficiency.

From a regional standpoint, logistics developments are strongest in aviation hubs such as Beijing, Shanghai, Guangzhou, Xi’an, Chengdu, and Shenzhen. These cities feature high-capacity airports, large MRO centers, and advanced multimodal logistics infrastructure. Continued investment in airport expansions and new hangar facilities is expected to reinforce China’s long-term leadership in global aviation logistics.

The competitive landscape features a mix of major international logistics providers, domestic aerospace companies, specialized component transport firms, and OEM-aligned service networks. Companies that offer strong LSL (lean, smart, localized) capabilities—such as automation, optimized routing, and local component stocking—are gaining the largest market share. Collaboration between OEMs and Chinese carriers is also expanding, leading to more integrated maintenance programs and shared logistics platforms.

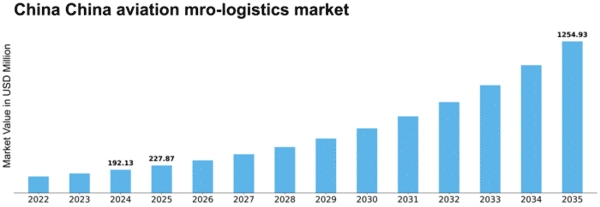

Looking ahead, the China Aviation MRO Logistics Market is forecast to witness sustained growth driven by technological innovation, supply chain resilience, and increasing fleet diversity. The role of AI-enhanced logistics planning, autonomous warehousing, and smart transport systems is expected to expand considerably. As market size expands and competition intensifies, logistics efficiency will become a defining success factor in China’s aviation industry. With strong government backing and rising global recognition, China is well positioned to lead the next generation of aviation MRO logistics transformation

Related Report: