Inflight Shopping Market Research Report: Passenger Spending Patterns & Future Growth

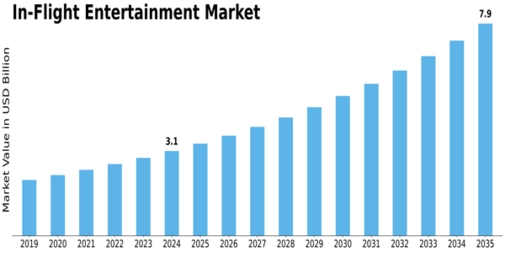

The global inflight shopping market is filled with untapped opportunity, and as air travel continues to expand, airlines are recognizing the power of onboard retail as a revenue engine. (MRFR) reports that the market—valued at USD 7.62 billion in 2024—will climb to USD 13.67 billion by 2035, driven by a combination of rising passenger traffic, digital transformation, and strategic diversification of product offerings across airlines worldwide.

Among the biggest opportunity hotspots is the Europe Inflight Shopping Market, which remains one of the industry's most stable and high-value regions. With a projected increase to USD 2,562.40 million by 2035, Europe benefits from a heavy concentration of frequent flyers, interconnected international routes, and flagship airlines that prioritize enhanced onboard experiences. Additionally, Europe’s strong affinity for premium retail brands and luxury items supports sustained demand for inflight shopping, particularly among business and international travelers.

Europe also leads in integration of digital inflight retail ecosystems. Many carriers are incorporating pre-order systems, allowing passengers to browse and reserve items before boarding. These systems increase purchase intent, reduce inventory waste for airlines, and create opportunities for high-margin brand partnerships. MRFR’s emphasis on “digital integration enhancing customer experience” underscores why Europe continues to dominate innovation in this sector.

In contrast, the LATAM Inflight Shopping Market presents a different type of opportunity—growth at scale. With its market projected to nearly double from USD 3.5 billion in 2024 to USD 7.2 billion by 2035, Latin America benefits from flourishing tourism, rapid digitization of airline services, and growing consumer demand for international and duty-free goods. This region represents the ideal environment for airlines to introduce mobile-based inflight shopping, curated assortments for leisure travelers, and accessible price ranges that match the region’s expanding middle-class passenger base.

Another area ripe with opportunity is product innovation. Categories such as beauty & care, travel comfort products, children's items, and tech accessories continue to grow as airlines expand beyond traditional duty-free. MRFR’s segmentation shows “others” as a robust category—indicating passenger appetite for unique or flight-exclusive items. Airlines that collaborate with brands to introduce limited-edition inflight-only products can create strong demand and higher spending per passenger.

Furthermore, increasing adoption of modern retail technologies unlocks new revenue streams. With advancements such as digital catalogs, seamless payment gateways, AI-curated recommendations, and personalized retail experiences, airlines can now monetize passenger engagement more efficiently than ever before. These features work particularly well on long-haul routes, where passengers have more time to shop at leisure—supporting stronger conversion rates.

A significant opportunity lies in carrier type segmentation. Full-service carriers dominate the inflight shopping market, but low-cost carriers (LCCs) are increasingly adopting retail-led revenue models. As MRFR highlights rising online shopping and onboard automation, LCCs are well positioned to expand inflight retail by leveraging mobile-based ordering and offering value-driven assortments.

What ultimately makes the global inflight shopping market so compelling is its convergence of aviation, retail, and digital commerce. With a clear growth trajectory to USD 13.67 billion by 2035, supported by strong regional demand in Europe and LATAM, the industry offers airlines, brands, and technology providers vast potential for innovation and revenue creation.

Related Report:

More Electric Aircraft Market OverView

Aerospace Composites Market OverView