Crop Monitoring Market To Witness Strong Demand from Agronomists and Seed Companies

Crop Monitoring Market to Reach USD 9.46 Bn by 2030 Amid Rising Digitalization in Global Agriculture

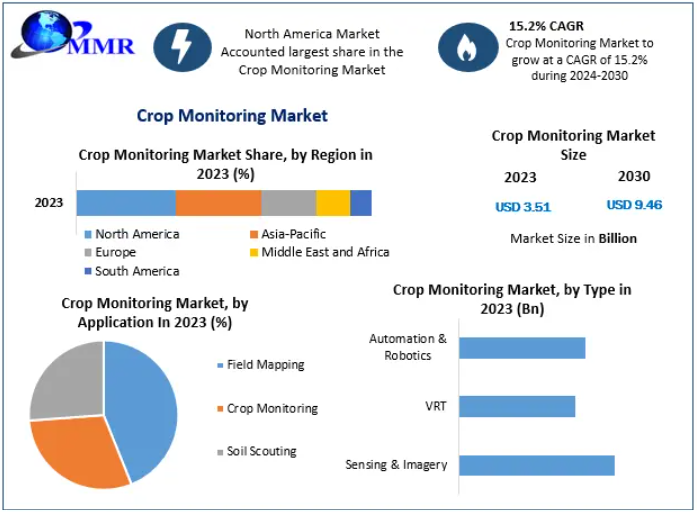

The global Crop Monitoring Market, valued at USD 3.51 billion in 2023, is set for significant expansion, projected to reach USD 9.46 billion by 2030, growing at a CAGR of 15.2% during the forecast period. The surge in adoption of digital agricultural technologies, combined with the rising need for food security, is redefining how farms are monitored, managed, and optimized across global markets.

Transforming Agriculture Through Continuous Monitoring

Crop monitoring has rapidly evolved from basic field scouting to an advanced, technology-driven practice that uses geospatial tools, remote sensing, sensors, automation, robotics, and data analytics. As nations invest in food security and sustainable farming, crop monitoring solutions are positioned as indispensable tools for predictive analytics, optimized resource usage, and early detection of crop issues.

Remote sensing technology—once limited to research—is now entering mainstream farming, offering accuracy levels between 70–90% depending on crop type and field conditions. These digital solutions provide actionable insights into crop health, pest and disease detection, moisture levels, nutrient status, and overall farm productivity.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148144/

Market Dynamics Driving Growth

Key Growth Drivers

- Rising Adoption of IoT, AI, and Smart Sensors

IoT and artificial intelligence are fundamentally reshaping modern agriculture. Companies such as Prospera Technologies, Blue River Technology, Trimble, Bosch, CropIn Technology, and Sigfox are pioneering innovations in connected devices, smart farming, and real-time monitoring.

Low-cost, high-precision smart sensors now deliver granular insights on soil quality, moisture, plant health, and climatic conditions—enabling farmers to make timely and data-backed decisions.

- Growing Concerns About Global Food Security

With population growth accelerating worldwide, governments are boosting investments in advanced agricultural technologies such as automation, robotics, drones, and imaging platforms. These technologies enable high-accuracy yield forecasting and early detection of crop threats, improving food availability and minimizing losses.

Market Restraints

- Lack of Skilled Labor and Digital Awareness

In many developing regions, rural–urban digital inequality slows the adoption of precision farming technologies. Barriers such as limited technical knowledge, absence of digital infrastructure, resistance to technology among conventional farmers, and low awareness of advanced monitoring solutions restrict market penetration.

- Limited Digitalization in Traditional Farming Areas

Family-owned small farms often operate on manual or semi-manual systems, making them slow to transition to modern technologies, thereby impacting market expansion in emerging countries.

Market Opportunities

- Post-Pandemic Digital Transformation in Agriculture

The COVID-19 pandemic created severe disruptions in supply chains and labor availability, pushing agricultural stakeholders to adopt automated and digital solutions. Digitally enabled services, remote monitoring platforms, and crop intelligence systems have become an attractive investment arena for agri-tech companies.

As farmers increasingly recognize the benefits of automated support and resource optimization, digital agriculture is emerging as a powerful driver of long-term industry growth.

Crop Monitoring Market Segment Analysis

By Technology

- Sensing & Imagery – 43% Market Share (2023)

The largest segment, driven by booming adoption of satellite imaging, drone imaging, and remote sensing technologies. These tools provide detailed field maps, vegetation indices, and crop health assessments.

- Automation & Robotics – 34% Market Share

Expected to grow fastest as farmers adopt robotic tools to counter labor shortages. Robotics enable automated seeding, spraying, scouting, and harvesting—enhancing precision and efficiency.

- Variable Rate Technology (VRT) – 23% Market Share

VRT enables precise application of fertilizers, pesticides, and irrigation—reducing costs and enhancing sustainability across variable field zones.

By Application

- Crop Monitoring – 40% Market Share

The dominant application, driven by the rising need to detect diseases, nutrient deficiencies, and pest infestations early. Real-time monitoring helps farmers apply timely interventions.

- Soil Scouting – 33% Market Share

Crucial for identifying suitable soil properties for specific crops, soil health management, moisture measurement, and fertility diagnostics.

- Field Mapping – 27% Market Share

Used to create precision-based digital farm maps that guide planting patterns, irrigation layout, and farm resource utilization.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148144/

Regional Insights

North America – 43.2% Market Share

The leading region, led by strong presence of precision agriculture giants like Trimble, John Deere, AGCO, and Raven Industries. Widespread adoption of smart farming tools and government initiatives supporting agricultural innovation drive the market.

Asia Pacific – 22% Market Share

A rapidly growing region due to heavy adoption of agri-tech in India, China, Japan, and Australia. Government reforms promoting digital agriculture and large-scale farming modernization significantly contribute to regional growth.

Europe – 16% Market Share

Growth driven by sustainability mandates, environmental monitoring regulations, and adoption of data-driven decision-making tools in farming communities.

South America – 12.6% Market Share

Moderate adoption due to limited investments and economic challenges; however, large agricultural regions like Brazil are increasingly adopting remote sensing and drone technologies.

Middle East & Africa – 6.2% Market Share

Growth remains modest due to limited digital infrastructure, though precision farming adoption is gradually rising in GCC countries.

Competitive Landscape

The crop monitoring market includes global leaders, innovators, and emerging startups offering imaging systems, data analytics, automation, and farm management solutions.

Key Players Include:

- John Deere

- Agrisource Data

- Raven Industries

- AGCO Corporation

- Pessl Instruments

- Mouser Electronics

- Topcon Corporation

- Agjunction

- Taranis Visual

- CorpX

- Trimble

- Yara International ASA

- The Climate Corporation

These companies are focusing on AI-based data platforms, integrated sensor ecosystems, imaging technologies, and precision agriculture tools to deliver customized crop intelligence and farm analytics.

Conclusion

The global Crop Monitoring Market is entering a high-growth phase driven by digital transformation, rising food security concerns, and strong adoption of AI, IoT, sensing technologies, and automation. As farmers transition toward data-led decision-making, the industry is poised to expand significantly across all major regions.

With leading agri-tech companies investing in innovation and governments supporting smart farming, the market will continue to evolve as a critical pillar of modern agriculture—enhancing productivity, sustainability, and crop resilience worldwide.