From Struggle to Stability: How Fast Funding Saves Growing Startups

Starting a startup feels like a rollercoaster. One day, you're buzzing with ideas. The next, cash runs low. Inventory waits. Hires stall. That exciting launch? Delayed. Growing businesses face this often. Sudden needs hit hard. A big order comes in. You need stock fast. Or marketing to grab it. Without quick cash, opportunities slip. Dreams fade. But fast funding changes that. It's money you get in days. Not months. No long papers. Just simple steps. In Saudi Arabia, where startups boom, this is key. Vision 2030 backs it. More loans for small firms. Easier access. Fast funding turns struggle to stability. It lets you grab chances. Hire right. Grow steady. In this post, we keep it simple. We share why it works. How to get it. Real stories. You'll feel ready to borrow. Let's turn your hustle to harmony.

Why Growing Startups Need Fast Funding

Startups grow quick. Sales spike. Then cash lags. You wait for payments. But bills don't. Rent. Salaries. Ads. They come now.

Fast funding fills the gap. It's like a bridge. Over cash crunches. You buy stock. Pay teams. Launch campaigns. Without it, you miss sales. Competitors win.

Take Saudi Arabia. Small businesses make 99% of firms. They drive jobs. But funding waits slow them. Traditional banks take weeks. Ask for big collateral. New owners lack it.

Digital loans fix this. Approval in 24-72 hours. Funds up to SAR 1 million. Rates 8-12%. No heavy history needed. They look at sales. Invoices. Not just credit.

Benefits stack. You seize deals. Like a sudden order. Buy materials fast. Deliver on time. Customers happy. Repeat business grows.

It builds stability too. Pay on time. Credit rises. Next loan easier. No debt traps. Flexible terms match your flow.

In short, fast funding isn't a loan. It's a launchpad. From scramble to smooth.

The Struggle of Slow Funding: Real Pains for Startups

Slow money hurts hard. You spot a trend. Vegan snacks hot. You want to stock up. But bank says wait 30 days. Price jumps. Chance gone.

Hires wait too. Top talent applies. You need cash for salary. Delay? They leave. Team gaps grow.

Marketing misses. Ad campaign ready. Budget short. Run late? Buzz fades.

One study shows 82% of startups fail from cash issues. Slow funding feeds that. In KSA, SMEs wait average 60 days for bank loans. Digital cuts to 5 days.

Pains add stress. Owners burn out. Focus slips. Growth stalls.

Fast funding ends it. Quick cash. Quick wins. Stability starts.

Common Struggles

- Missed Opportunities: Deals die waiting.

- Team Gaps: Hires walk away.

- Cash Crunch: Bills pile. Sales wait.

- Stress Build: Owners worry more.

- Growth Slow: Competitors pull ahead.

Spot yours? Fast fix waits.

How Fast Funding Works for First-Time Borrowers

Fast funding uses tech. Apps check your business online. No branch visits.

You apply. Upload license. Bank statements. Sales proof. AI scans it. 3-7 days? Approval.

Funds come direct. To your account. Use for anything. Stock. Hires. Ads.

Repay flexible. Monthly chunks. Match your sales. No big lumps.

In KSA, options grow. Kafalah guarantees loans. Up to 80%. Banks join. Low risk.

Monsha'at gives grants. SAR 500,000. No repay. For startups.

P2P platforms like Lendo connect you to investors. Rates fair. Quick.

The Best finance company like Funding Souq offers digital loans. Up to SAR 1 million. In days.

It's simple. Safe. SAMA licenses all. Data protected.

Work for you? Yes. Even with short history. They use other data.

Step-by-Step Guide to Getting Fast Funding

Ready to start? Follow these steps. Keep it easy.

Step 1: Know your need. How much? SAR 50,000 for stock? SAR 100,000 for hires? Be exact.

Step 2: Gather docs. License. 6 months bank statements. Invoices. Sales report.

Step 3: Pick lender. Check SAMA license. Read reviews. Compare rates. 8-12% good.

Step 4: Apply online. Fill form. Upload files. Answer "How use funds?" Clear plan.

Step 5: Wait smart. 24-72 hours for pre-approval. Full in 5 days. Track in app.

Step 6: Get cash. E-sign. Money lands. Use it. Grow it.

Step 7: Repay on time. Auto-debit helps. Build score for next.

In Riyadh, a Finance company Riyadh like Riyad Bank has fast apps. For SMEs.

Steps lead to cash. Cash leads to calm.

Success Stories: Startups That Won With Fast Funding

Real wins inspire.

Take Tamara. Payments app in KSA. Raised $340 million fast. Used for growth. Now, millions of users. Split payments easy.

Ninja, e-com tool. Got quick seed. Scaled fast. H1 2025 funding up 78%. Retailers love it.

Fitting, construction tech. $500,000 pre-seed quick. Built app. Now, sites run smooth.

Orbii, AI lending. Funding in weeks. Unlocks $1 billion SME cash by 2026.

These startups grabbed fast money. Turned struggle to scale.

Your turn? Same path waits.

Tips to Make Fast Funding Work for Your Startup

Borrow smart. Not just fast.

Tip 1: Plan use. "Funds for inventory." Track spend. Show results.

Tip 2: Build buffer. Save 10% extra. For slow months.

Tip 3: Pay early. Cuts interest. Builds trust.

Tip 4: Grow sales. Use cash to earn more. Payback easier.

Tip 5: Check options. Grants first. Loans next. Mix helps.

Tip 6: Learn from it. Next round bigger. Better rates.

Tips turn loans to ladders.

Quick Tips List

- Exact Amount: Borrow what you need.

- Track Spend: See money work.

- Early Pay: Save on interest.

- Sales Focus: Grow to repay.

- Mix Funds: Grants plus loans.

- Learn Always: Build for next.

Simple. Strong.

The Future of Fast Funding in Saudi Arabia

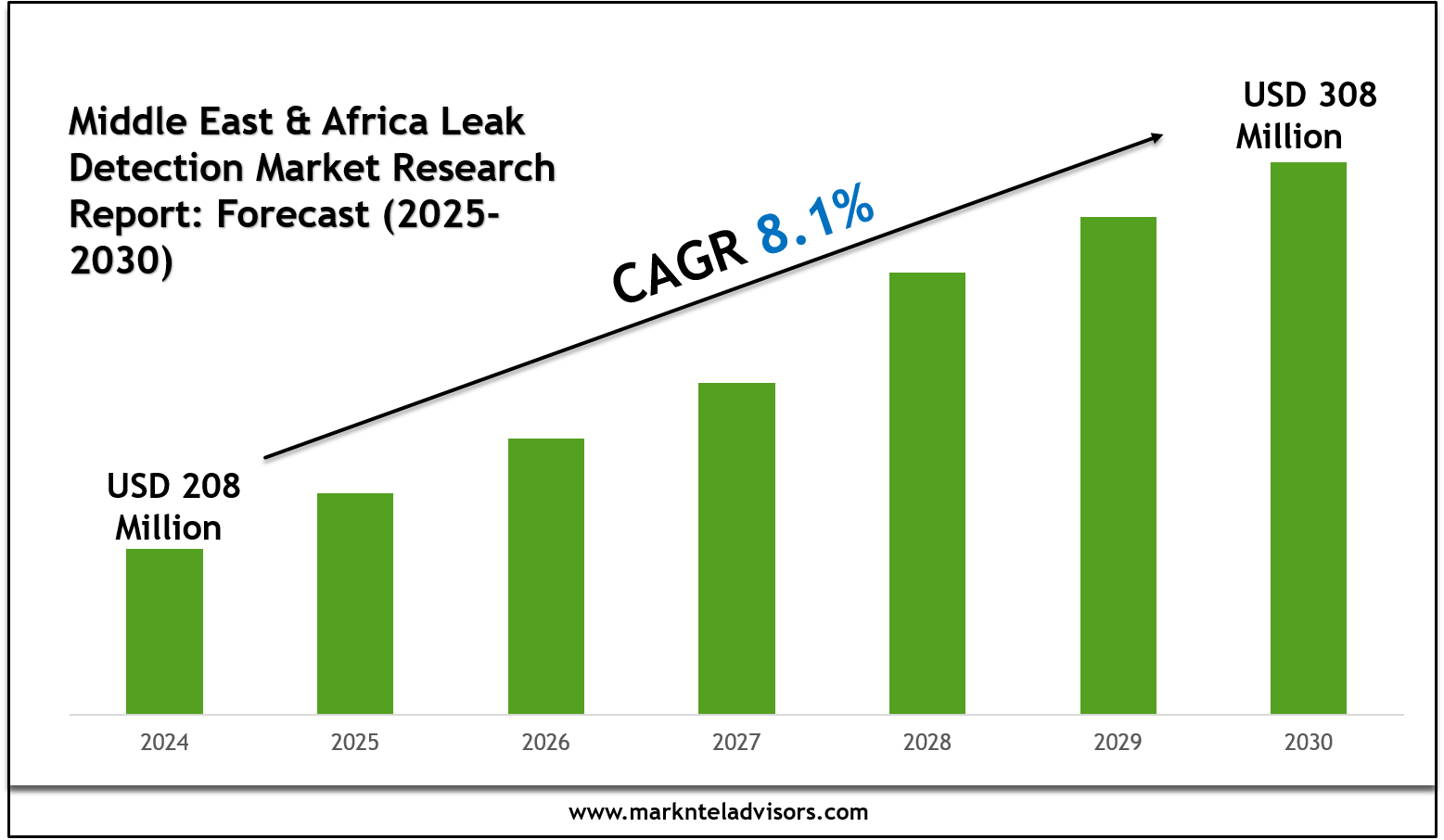

Funding speeds up. By 2030, 80% digital. AI approves in hours. Blockchain secures.

Vision 2030 pushes. SME loans to 20% bank books. More for startups.

P2P grows. Crowds fund dreams. Low rates. Quick cash.

For first-timers, doors wide. No history? Sales count more.

Future fast. Your startup fits.

Conclusion

Fast funding saves growing startups. From cash crunch to calm growth. In Saudi Arabia, tools like Kafalah and apps make it real. Quick approvals. Flexible terms.

Follow steps. Learn tips. Borrow wise. Watch your business bloom.

Ready? Apply today. Stability starts now.