Automotive V2X Market: Key Drivers, Trends, and Emerging Opportunities 2032

Global Automotive V2X Market: Growth, Outlook, and Future Landscape (2024–2032)

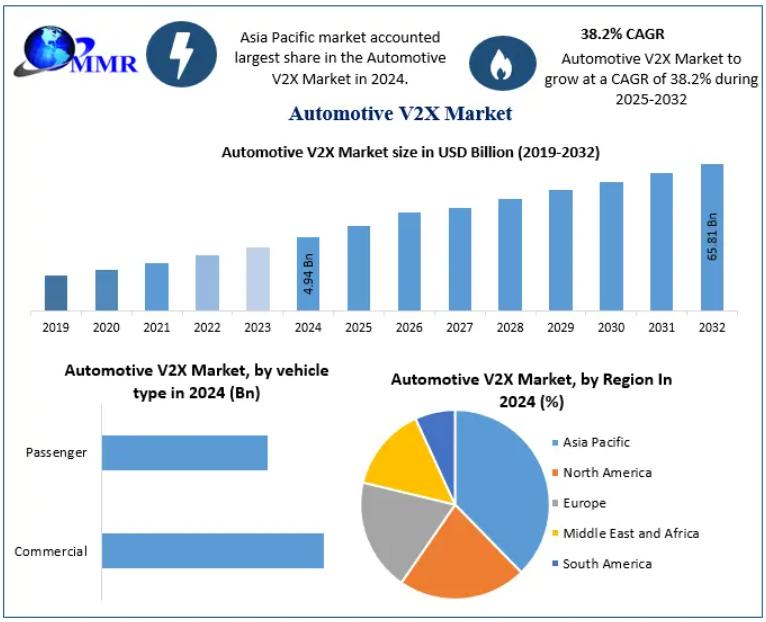

The Global Automotive Vehicle-to-Everything (V2X) Market, valued at USD 4.94 billion in 2024, is projected to grow at an exceptional CAGR of 38.2% between 2025 and 2032, reaching an estimated USD 65.81 billion. This massive expansion reflects rapid advancements in connected mobility, rising adoption of autonomous driving technologies, and the urgent global need to enhance road safety through real-time communication systems.

V2X technology enables vehicles to communicate with other vehicles (V2V), infrastructure (V2I), pedestrians (V2P), grids (V2G), networks (V2N), and homes (V2H). This communication ecosystem forms the backbone of next-generation intelligent transportation systems (ITS), supporting predictive safety, energy optimization, and traffic efficiency.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/9764/

Market Overview

Road safety is one of the primary drivers for V2X adoption. The World Health Organization (WHO) reports that over 1.36 million people die annually due to road accidents. Studies suggest that widespread implementation of V2X could reduce accident fatalities by up to 80%. In the United States alone, the NHTSA estimates that 615,000 vehicular crashes could be prevented through V2X-enabled systems.

With growing consumer awareness—over 90% of U.S. drivers prefer V2X-equipped vehicles—automakers worldwide are accelerating investments in connected ecosystems. The convergence of AI, 5G, edge computing, and automotive IoT is transforming traditional vehicles into intelligent, self-learning platforms capable of instant decision-making.

Report Scope & Methodology

The Automotive V2X Market Report evaluates:

- Market drivers, restraints, and opportunities

- Current and future trends

- Competitive landscape and key strategies

- Market segmentation by vehicle type, application, connectivity, communication type, and offering

A bottom-up approach was used to estimate market size, based on:

- Revenue analysis of key manufacturers

- Examination of R&D activities, mergers, investments, and product portfolios

- Interviews with industry experts, OEMs, and technology solution providers

The study provides a holistic view for investors, industry stakeholders, and policymakers.

Market Dynamics

1. Rapid Advancements in Connected Vehicle Technology

Automotive OEMs—including Ford, GM, Volkswagen, Mercedes-Benz, Hyundai, and Toyota—are investing heavily in connected mobility. This includes:

- 5G-enabled onboard communication

- Advanced driver assistance systems (ADAS)

- Autonomous driving hardware and software

- Predictive vehicle analytics

Hyundai’s strategic investment in Autotalks highlights the push for V2X chipsets designed for improved situational awareness and traffic safety. Similarly, GM plans to embed 5G connectivity across Cadillac, Chevrolet, and Buick models, transforming vehicles into high-speed communication nodes.

2. Emerging Role of AI and 5G in V2X Systems

AI and 5G serve as catalysts for real-time vehicle communication. Key impacts include:

- Ultra-low latency communication

- Faster response to hazards

- Real-time sensing and environment mapping

- Enhanced pedestrian detection and collision prevention

Cellular-V2X (C-V2X) is designed to support future 5G-V2X capabilities such as:

- Cooperative driving

- Platooning

- High-speed maneuvering

- Advanced automated driving (AAD)

This creates massive opportunities in the forecast period as connected road infrastructure expands globally.

3. Urbanization and Smart City Development Fueling Adoption

Countries worldwide are investing in smart cities, where:

- Data-driven transport

- Connected intersections

- Real-time traffic management

- Intelligent parking systems

become essential.

Macroeconomic factors such as GDP growth, rising disposable incomes, and rapid employment expansion have fueled new vehicle purchases and increased demand for predictive and safe mobility systems.

4. Infrastructure Limitations in Developing Nations

One barrier to mass V2X adoption is uneven network infrastructure, especially in:

- India

- Brazil

- Mexico

- South Africa

Challenges include:

- Limited high-speed mobile networks along highways

- Interoperability issues between communication standards

- Regulatory complexities related to telecom and data sharing

- High installation costs for roadside units (RSUs)

This gap may slow adoption in certain regions despite high demand.

Segmentation Analysis

By Vehicle Type

- Passenger Vehicles – Expected to record the highest CAGR

- Surge in connected car technologies

- Rising EV adoption

- Demand for advanced infotainment and ADAS

- Commercial Vehicles – Growing adoption of fleet connectivity and smart logistics systems.

By Communication Type

- Vehicle-to-Grid (V2G) is the fastest-growing segment.

- EVs can supply energy back to the power grid

- Supported by government programs in China, India, Japan, South Korea

- Strongly aligned with clean mobility goals

By Offering

Software – Fastest-growing segment

Demand is rising due to:

- Increasing V2X integration

- Need for interoperable platforms that support both DSRC and C-V2X

- Growth of cloud connectivity and OTA updates

Companies like Commsignia are creating software stacks compatible with multiple V2X protocols.

By Connectivity

Cellular Connectivity (C-V2X) dominates the market

Benefits include:

- Low latency

- High bandwidth

- Seamless long-range and short-range communication

- Better compatibility with 5G

DSRC still exists but is not growing as fast due to network infrastructure limitations.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/9764/

Regional Insights

Asia Pacific – The Global Leader

The Asia Pacific region dominates due to:

- Strong automotive production in China, Japan, South Korea, and India

- Rising EV adoption

- Government policies for smart mobility

- High penetration of C-V2X systems

China holds a 45% penetration in connected vehicles, while South Korea and Japan leverage their electronics strength to produce cost-efficient V2X solutions.

Major regional players:

- Denso

- Mitsubishi Electric

- Hitachi

- Huawei

- Hyundai Motor Company

Europe – Rapid Expansion Supported by Regulations

Europe is expected to show strong growth due to:

- EuroNCAP’s roadmap mandating V2X integration

- Stringent road safety policies

- Early commercialization of connected vehicles

- Wide adoption of LTE-V2X and emerging 5G-V2X deployments

Qualcomm’s chipset certification in Europe has accelerated OEM integration.

North America – Technology Pioneer

Strong ecosystem supported by:

- High consumer demand for connected vehicles

- Early adoption of 5G infrastructure

- Investments by companies like Qualcomm, Intel, and Harman

- Government initiatives for smart highway systems

Competitive Landscape

Global leaders driving the Automotive V2X market:

- Intel Corporation (US)

- Qualcomm Technologies Inc. (US)

- Harman International Industries (US)

- Nvidia Corporation (US)

- NXP Semiconductors (Netherlands)

- TomTom International (Netherlands)

- Autotalks Ltd. (Israel)

- Cohda Wireless (Australia)

- Continental AG (Germany)

- Daimler AG (Germany)

- Audi AG (Germany)

- Infineon Technologies (Germany)

- Robert Bosch GmbH (Germany)

These companies focus on:

- Chipset development

- Software platforms

- Sensor fusion

- ADAS integration

- Strategic partnerships and acquisitions

Conclusion

The Automotive V2X Market is entering a transformative era shaped by:

- The integration of AI and 5G

- Rapid electrification

- Autonomous driving evolution

- Smart city development

With governments and OEMs racing to deploy intelligent mobility solutions, V2X technology is set to become a core component of next-generation transportation systems. By 2032, V2X will not only improve road safety but also revolutionize the way vehicles interact with society, infrastructure, and the digital world.