Mining Equipment Market: Sustainability Trends and Eco-Efficient Machinery 2030

Mining Equipment Market: Global Trends, Innovations, and Growth Outlook to 2030

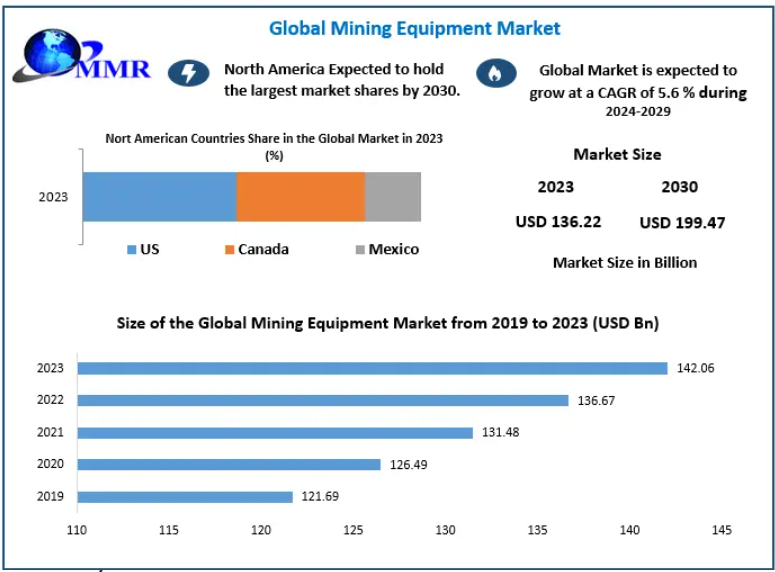

The Global Mining Equipment Market, valued at USD 136.22 billion in 2023, is projected to reach USD 199.47 billion by 2030, expanding at a CAGR of 5.6%. The rising global appetite for minerals, metals, and energy resources continues to accelerate the demand for technologically advanced and efficient mining machinery across multiple industry verticals.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/25027/

Market Overview

Mining equipment plays a foundational role in the extraction, processing, and transportation of minerals and geological materials. From drilling and excavation to crushing and hauling, mining machinery is engineered to operate under harsh conditions while delivering high levels of productivity and safety.

Key categories include:

- Excavation & Loading Equipment – backbone machines enabling efficient digging and loading

- Drilling Equipment – essential for creating boreholes and accessing underground resources

- Blasting Tools – critical for breaking rock formations

- Haul Trucks – heavy-duty vehicles transporting ore to processing plants

The increasing integration of automation, electrification, and smart technologies is reshaping mining operations globally, pushing companies toward greater sustainability, efficiency, and cost optimization.

Market Dynamics

1. Rising Demand for Metals & Minerals

The global shift toward industrialization, urbanization, and advanced manufacturing is driving massive demand for metals such as copper, iron ore, aluminum, chromium, and rare earth elements. This directly fuels investments in next-generation mining machinery designed to improve extraction efficiency and reduce operational downtime.

2. Expansion of Exploration Activities

Growing interest in discovering untapped mineral reserves, especially in developing economies, is increasing the deployment of high-performance drilling, exploration, and excavation equipment. Advanced technologies enable deeper, safer, and more precise exploration activities.

3. Shift Toward Battery-Electric & Zero-Emission Machinery

Diesel-powered mining machines emit heat, noise, and pollutants—challenging underground working conditions and requiring expensive ventilation infrastructure.

Battery-operated or electric mining equipment offer significant advantages:

- Zero emissions

- Cleaner air and reduced heat

- Lower noise levels

- Reduced ventilation costs

- Safer, ergonomic operator cabins

High-energy-density battery systems are transforming underground mining, making operations more sustainable and cost-effective.

4. Technological Advancements: Automation, IoT & Drones

Automation continues to revolutionize mining operations. Key innovations include:

- Telematics & IoT sensors for predictive maintenance and real-time fleet monitoring

- Autonomous haul trucks & loaders improving safety and efficiency

- Drones for mine mapping, blast monitoring, and safety inspections

These technologies reduce downtime, optimize resource utilization, and enhance operator safety.

5. Restraint: Preference for Used Equipment in Developing Markets

Countries like South Africa, Argentina, and Peru often rely on pre-owned machinery due to lower costs and longer machine life cycles. This reduces demand for new equipment in price-sensitive regions, posing a challenge to market expansion.

Segment Analysis

By Electric Equipment

Surface Mining Equipment – Dominant Segment

Surface mining equipment, which includes electric mining trucks and LHD loaders, accounted for the largest share in 2023 and is projected to maintain its lead.

Why this segment dominates:

- High demand for minerals like coal, iron ore, and diamonds

- Increased adoption of equipment supporting selective mining

- Growing infrastructure development in emerging economies

By Application

Metal Mining – Leading Segment

Metal mining is expected to dominate throughout the forecast period due to rising demand for aluminum, steel, copper, and other metals used in:

- Construction

- Automotive

- Manufacturing

- Infrastructure development

Rapid urbanization in India, China, and Southeast Asia significantly propels the demand for metal mining equipment.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/25027/

Regional Insights

North America – Technologically Advanced Mining Hub

North America is a mature market with advanced mining operations, especially in the United States. The region leads in adopting:

- Automated hauling systems

- Hybrid and electric mining trucks

- Predictive maintenance solutions

Strict safety and environmental regulations further drive modernization.

Europe – Sustainability-Focused Mining Market

Europe's mining equipment landscape is shaped by emphasis on:

- Eco-friendly machinery

- Reduced carbon emissions

- Responsible mining practices

Germany leads the region, backed by strong regulatory frameworks and investments in green mining technologies.

Asia-Pacific – Fastest-Growing Market

APAC is the powerhouse of global mining, supported by:

- Massive mineral reserves

- Growing infrastructure projects

- High demand for coal, metals, and rare earths

China, India, Japan, and Australia are major contributors, making APAC the most dynamic and rapidly expanding region.

Middle East & Africa – Emerging Opportunity Zone

Africa's abundant mineral resources (gold, cobalt, copper, diamonds) combined with growing exploration activities are fueling regional market expansion. Supportive government policies and foreign investments are strengthening MEA’s mining infrastructure.

South America – Strong Potential

Brazil leads the region with large deposits of iron ore, nickel, and copper. The region is increasingly adopting modern equipment to improve productivity and sustainability.

Competitive Landscape

The market is highly competitive with global manufacturers focusing on electrification, digitalization, and strategic collaborations.

Key Global Players

- AB Volvo (Sweden)

- Hyundai Heavy Industries (South Korea)

- Doosan Group (South Korea)

- Terex Corporation (USA)

- Astec Industries (USA)

- Metso Corporation (Finland)

- Sandvik AB (Sweden)

- Liebherr Group (Switzerland)

- Komatsu Ltd. (Japan)

- Hitachi Co. Ltd. (Japan)

- China Coal Energy (China)

These companies offer wide portfolios covering crushing, drilling, hauling, material handling, and mineral processing equipment.

Notable Strategic Collaborations

1. Albemarle–Caterpillar Partnership (2023)

Aimed at building North America’s first zero-emissions lithium mine, the collaboration focuses on:

- Battery-electric haul trucks

- Sustainable mining equipment

- Joint R&D in battery technology and recycling

This partnership accelerates the transition to clean-energy mining.

2. Komatsu–Cummins Collaboration

Komatsu and Cummins have joined forces to develop hydrogen fuel-cell–powered haulage equipment, advancing the industry toward carbon neutrality by 2050.

Conclusion

The global Mining Equipment Market is undergoing a major transformation driven by electrification, digital innovation, sustainability goals, and increased exploration. As mining companies shift toward cleaner, safer, and more efficient operations, demand for advanced machinery—electric trucks, autonomous loaders, intelligent drilling systems—continues to grow.

By 2030, the industry will be defined by:

✔ Zero-emission mining fleets

✔ Automation-powered productivity

✔ Smart, connected equipment

✔ Sustainable resource extraction

The companies that invest early in innovation, automation, and eco-friendly technologies will solidify their position in this highly competitive and fast-evolving market.