E-Rickshaw Market: Rising Demand for Affordable and Eco-Friendly Transport 2032

E-Rickshaw Market Research Report (2025–2032)

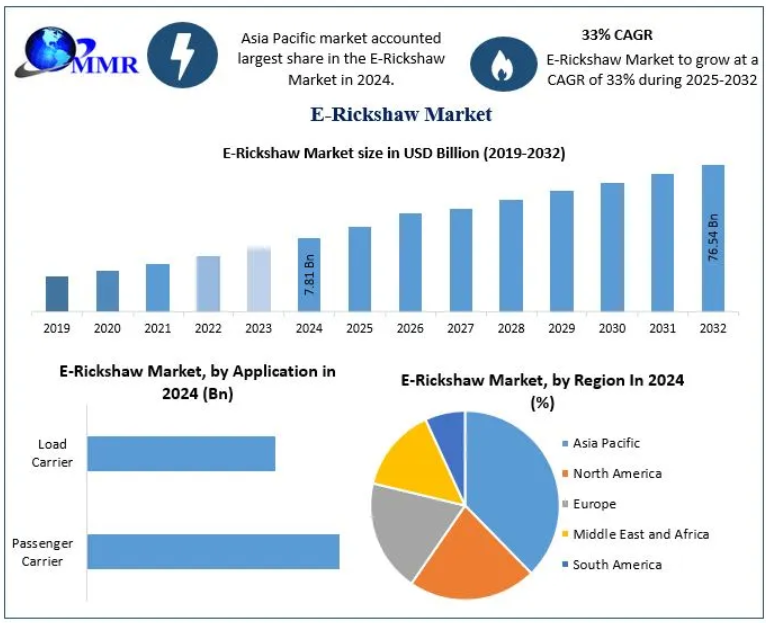

Market Size Worth USD 76.54 Billion by 2032, Registering a CAGR of 33%

E-Rickshaw Market Overview

The Global E-Rickshaw Market, valued at USD 7.81 billion in 2024, is set for exponential expansion, projected to reach USD 76.54 billion by 2032 at a thriving 33% CAGR. E-rickshaws—lightweight electric three-wheelers—have become a critical component of urban mobility, particularly across Asia’s densely populated cities.

Powered by an electric drivetrain and traction motor, e-rickshaws offer an affordable, efficient, and eco-friendly solution for both passenger and goods transportation. Their ability to navigate congested urban lanes at a low operating cost makes them a preferred choice in India, China, and ASEAN countries.

Growing environmental regulations, lucrative government incentives, increasing urbanization, and rising consumer acceptance of sustainable mobility solutions are fuelling the rapid adoption of e-rickshaws globally.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/72844/

E-Rickshaw Market Dynamics

Key Growth Drivers

1. Low-Cost Urban Mobility

E-rickshaws offer cheaper fares for passengers and significantly lower operational costs for drivers compared to ICE-powered auto rickshaws. This economic advantage is a major market booster, especially in developing nations.

2. Rapid Urbanization & Traffic Congestion

Cities across India and Southeast Asia are expanding rapidly. E-rickshaws maneuver smoothly through congested city roads, making them ideal for last-mile connectivity.

3. Stricter Emission Standards

Governments are implementing severe emission norms to curb urban pollution. Subsidies, tax exemptions, and financing schemes are accelerating the transition to electric mobility.

4. Demand for High-Capacity Batteries

As drivers seek higher daily range, the demand for high-capacity batteries (1000W–1500W and above) is rising. These vehicles provide improved performance and longer operating hours.

Restraints

1. Lack of Charging Infrastructure

Insufficient public charging stations remain a major barrier, particularly outside Tier I urban centers.

2. Battery Maintenance and Replacement Costs

Lead-acid batteries dominate due to lower upfront costs, but they require frequent replacement, impacting long-term profitability.

3. Presence of Unorganized Manufacturers

The unregulated manufacturing landscape in regions like India leads to inconsistent product quality and safety concerns.

E-Rickshaw Market Segment Analysis

By Product Type

-

Up to 1000W

-

Suitable for small urban routes

-

Lower cost, high-volume market

-

-

1000W – 1500W (Fastest Growing Segment)

-

High range

-

Better load capacity

-

Strong demand from commercial fleet operators

-

-

More than 1500W

-

Emerging segment

-

Used for load carriers and extended routes

-

By Application

-

Passenger Carrier (Dominant Segment)

-

High adoption across India, China, and ASEAN

-

Used for last-mile mobility

-

-

Load Carrier

-

Increasing demand from e-commerce, FMCG, and retail

-

Supports intra-city goods delivery

-

Regional Insights

1. Asia Pacific – Largest and Fastest-Growing Market

-

Accounts for the bulk of global demand

-

India and China dominate production and consumption

-

Supportive policies, scrappage programs, and rising urban population

2. Europe & North America

-

Emerging markets for electric rickshaws

-

Demand driven by sustainability goals and community mobility solutions

3. Middle East & Africa

-

Adoption supported by rising urbanization in African nations

-

Governments promoting greener, low-cost transportation for commercial use

4. South America

-

Gradual adoption in Brazil, Colombia, Argentina

-

Increasing awareness of electric mobility

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/72844/

Competitive Landscape

The E-Rickshaw Market is highly fragmented, featuring a mix of organized manufacturers, local assemblers, and emerging EV startups. Key strategies include battery innovation, price optimization, and distribution network expansion.

Key Players

-

HHW Care Products India Pvt. Ltd

-

Mahindra Electric Mobility Limited

-

Microtek

-

The Nezone Group

-

Arna Electric Auto Pvt. Ltd

-

Green Valley Motors

-

Bajaj Auto Limited

-

SuperEco Automotive Co. LLP

-

HITEK ELECTRIC AUTO CO

-

Yuva E Rickshaw

-

PACE ELECTRIC VEHICLES

-

Charuvikram Automobiles Pvt. Ltd

-

A G International Pvt. Ltd

-

Saera Electric Auto Pvt. Ltd

-

Gauri Auto India Pvt. Ltd

-

Xuzhou Hongsengmeng Group

-

Wuxi Weiyun Motor Co. Ltd

-

Wuxi Berang International Trading Co. Ltd

-

Udaan E_Rickshaw

-

Goenka Electric Motor Vehicles Pvt. Ltd

-

Mini Metro EV LLP

Players are focusing on:

-

Lithium-ion battery integration

-

Smart BMS (Battery Management Systems)

-

Lighter chassis materials

-

Higher power motors

-

Fleet-level servicing

Market Outlook (2025–2032)

The E-rickshaw market will witness massive transformation over the next decade:

| Trend | Impact |

|---|---|

| Shift to Lithium-ion batteries | Longer life, lower maintenance |

| OEM-led standardization | Improved safety, reliability |

| Digital financing solutions | Easier driver onboarding |

| Rise of e-commerce deliveries | Boost for load-carrying models |

| Government-led EV mandates | Rapid shift from ICE to electric |

By 2032, Asia Pacific will remain the global hub, but adoption in Europe, North America, and Africa will accelerate as urban centers move toward sustainable micro-mobility.

Conclusion

The Global E-Rickshaw Market is entering a high-growth phase driven by sustainability, economic viability, and rapid urban expansion. With a projected market value of USD 76.54 billion by 2032, the sector offers substantial opportunities for OEMs, battery manufacturers, investors, and mobility service providers.