Pet Insurance Market Companies: Growth, Share, Value, Size, and Insights By 2032

Executive Summary Pet Insurance Market Value, Size, Share and Projections

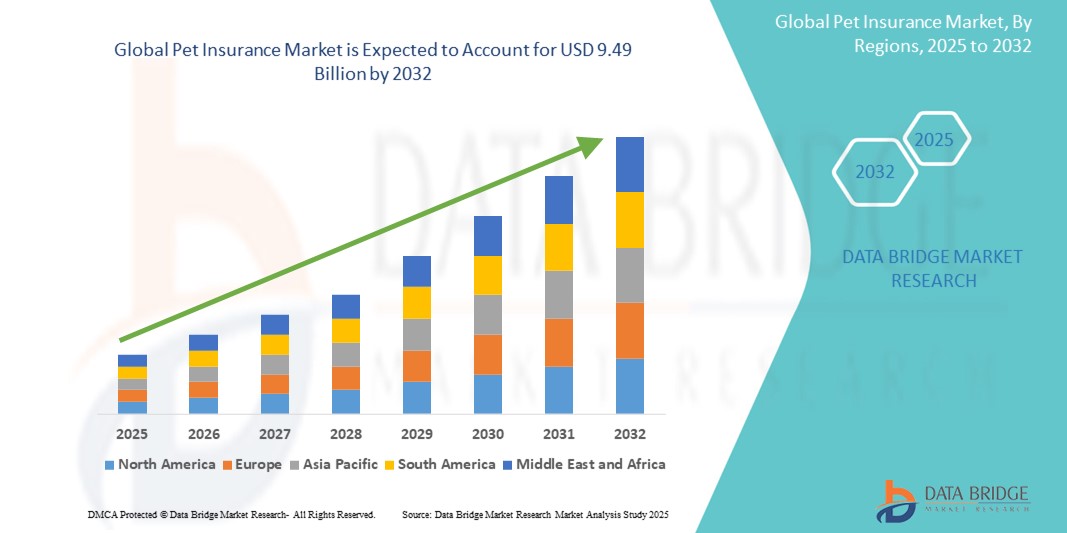

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period.

The top notch Pet Insurance Market report explains current and future market trends and carries out analysis of the impact of buyers, substitutes, new entrants, competitors, and suppliers on the market. This market research report is prepared with a nice blend of industry insight, smart and practical solutions and newest technology to present better user experience. The report has bottomless knowledge and information on what the market’s definition, classifications, applications, and engagements are and also explains the drivers and restraints of the market which is derived from SWOT analysis. An international Pet Insurance Market report also provides better market insights with which driving the business into right direction becomes easy.

Pet Insurance Market research report lends a hand to business in every sphere of trade to take first-class decisions, to tackle the toughest business questions and reduce the risk of failure. The significant highlights of this market report are key market dynamics, current market scenario and future prospects of the sector. The large scale Pet Insurance Market document is an absolute overview of the market that spans various aspects such as product definition, customary vendor landscape, and market segmentation based on various parameters such as type of product, its components, type of management and geography.

Plan smarter with expert insights from our extensive Pet Insurance Market research. Download now:

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market

Pet Insurance Business Landscape Review

Segments

- By policy type:

- Lifetime Cover

- Non-lifetime Cover

- Accident-only

- Others

- By animal type:

- Dogs

- Cats

- Others

- By provider:

- Insurance Companies

- Stand-alone Providers

- Others

Pet insurance is a growing market driven by the increasing adoption of pets and rising healthcare costs for animals. The market is segmented by policy type, animal type, and provider. By policy type, the market is categorized into lifetime cover, non-lifetime cover, accident-only, and others. Lifetime cover policies are popular as they offer coverage for chronic and recurring conditions throughout a pet's life. Non-lifetime cover policies provide coverage up to a certain limit per condition. Accident-only policies focus on covering injuries resulting from accidents. In terms of animal type, the market is divided into dogs, cats, and others. Dogs account for a significant share due to their higher susceptibility to illnesses and injuries. Cats are also driving market growth with the increasing awareness of their health needs. The market is further segmented by provider, including insurance companies, stand-alone providers, and others. Insurance companies offer pet insurance as part of their broader insurance products, while stand-alone providers specialize solely in pet insurance, catering to the specific needs of pet owners.

Market Players

- Embrace Pet Insurance

- Petplan Limited

- Pethealth Inc.

- Agria Pet Insurance

- Nationwide Mutual Insurance Company

- Trupanion

- ASPCA

- Hartville Group

- PetFirst Healthcare

- Petsecure

Key market players in the global pet insurance market include Embrace Pet Insurance, Petplan Limited, Pethealth Inc., Agria Pet Insurance, Nationwide Mutual Insurance Company, Trupanion, ASPCA, Hartville Group, PetFirst Healthcare, and Petsecure. These players offer a range of pet insurance products tailored to different needs and budgets of pet owners. Embrace Pet Insurance, for example, is known for its comprehensive coverage and customizable plans. Petplan Limited offers extensive coverage for illnesses and accidents, including hereditary and chronic conditions. Trupanion stands out for its straightforward reimbursement process and high coverage limits. As the demand for pet insurance continues to rise, these market players are focusing on innovative products, digital platforms, and strategic partnerships to expand their market presence and better serve pet owners.

The global pet insurance market is witnessing significant growth driven by several key factors. One emerging trend in the market is the increasing emphasis on preventive care and wellness coverage in pet insurance policies. Pet owners are becoming more proactive in managing their pets' health, leading to a shift towards policies that cover routine check-ups, vaccinations, and preventative treatments. This trend is influenced by the rising awareness of the importance of early detection and preventive measures in ensuring the overall health and well-being of pets. Market players are responding to this trend by incorporating wellness packages and preventive care options into their insurance offerings, catering to the evolving needs and preferences of pet owners.

Another noteworthy development in the pet insurance market is the integration of technology and data analytics to enhance customer experience and streamline insurance processes. Insurtech solutions, such as mobile apps for claims submission and real-time policy management, are becoming increasingly popular among pet insurance providers. These digital tools not only improve operational efficiency but also offer convenience and transparency to policyholders. By leveraging technology, market players can enhance customer engagement, personalize insurance products, and differentiate their offerings in a competitive market landscape.

Furthermore, the market is witnessing a surge in partnerships and collaborations between pet insurance providers and other industry stakeholders. Collaborations with veterinary clinics, pet food manufacturers, and retail chains are enabling insurers to offer bundled products and value-added services to pet owners. These partnerships not only enhance the overall customer experience but also drive customer loyalty and retention. Additionally, strategic alliances with online platforms and e-commerce players are expanding the reach of pet insurance products, tapping into a wider customer base and driving market penetration.

Moreover, the global pet insurance market is experiencing regulatory developments and standardizations aimed at ensuring consumer protection and promoting market transparency. Regulatory bodies are increasingly focusing on setting industry standards, guidelines, and consumer rights to foster a fair and competitive market environment. Compliance with regulatory requirements is becoming crucial for market players to build trust with customers, mitigate risks, and sustain long-term growth in the pet insurance industry.

In conclusion, the global pet insurance market is evolving rapidly, driven by changing consumer preferences, technological advancements, strategic collaborations, and regulatory initiatives. By adapting to these trends and seizing opportunities for innovation and partnership, market players can position themselves for sustainable growth and success in a dynamic and expanding market landscape. The pet insurance market is continuously evolving, driven by various factors that are shaping the industry landscape. One significant trend is the growing emphasis on preventive care and wellness coverage within pet insurance policies. Pet owners are increasingly prioritizing their pets' health, leading to a shift towards policies that encompass routine check-ups, vaccinations, and preventative treatments. This shift is influenced by a heightened awareness of the importance of early detection and preventive measures in maintaining pets' overall health and well-being. Market players are responding to this trend by incorporating wellness packages and preventive care options into their insurance offerings, catering to the changing needs and preferences of pet owners.

Additionally, the integration of technology and data analytics is playing a crucial role in enhancing customer experience and streamlining insurance processes within the pet insurance market. Insurtech solutions like mobile apps for claims submission and real-time policy management are gaining popularity among pet insurance providers. These digital tools not only enhance operational efficiency but also offer convenience and transparency to policyholders. Through the strategic use of technology, market players can improve customer engagement, personalize insurance products, and differentiate their offerings in a competitive market environment.

Furthermore, there is a notable increase in partnerships and collaborations between pet insurance providers and other industry stakeholders, such as veterinary clinics, pet food manufacturers, and retail chains. These collaborations enable insurers to offer bundled products and value-added services to pet owners, enhancing the overall customer experience and driving customer loyalty and retention. Strategic alliances with online platforms and e-commerce players are also expanding the reach of pet insurance products, tapping into a broader customer base and driving market penetration.

Regulatory developments and standardizations are another aspect shaping the global pet insurance market, focusing on ensuring consumer protection and fostering market transparency. Regulatory bodies are setting industry standards, guidelines, and consumer rights to create a fair and competitive market environment. Compliance with these regulatory requirements is becoming increasingly vital for market players to build trust with customers, manage risks effectively, and drive sustainable growth in the pet insurance industry.

In conclusion, the pet insurance market is undergoing rapid transformations driven by evolving consumer preferences, technological advancements, strategic collaborations, and regulatory initiatives. Market players that can adapt to these trends, innovate, and form strategic partnerships will be well-positioned for long-term success in a dynamic and expanding market landscape.

Dive into the company’s market size contribution

https://www.databridgemarketresearch.com/reports/global-pet-insurance-market/companies

Pet Insurance Market Intelligence: Key Analytical Question Sets

- What is the worldwide market size for the Pet Insurance industry?

- What is the estimated growth per annum from 2025 onward?

- Which features are used to segment the Pet Insurance Market?

- Who are the industry disruptors?

- What cutting-edge products are reshaping the Pet Insurance Market?

- Which countries are leaders in market adoption?

- What region leads in terms of export demand?

- Which countries offer the best expansion environment?

- Which regional market has plateaued?

Browse More Reports:

Europe Shiitake Mushroom Market

Europe Artificial Blood Substitutes Market

U.S. Frozen Yogurt Market

Middle East and Africa Left Ventricular Assist Device (LVAD) Market

Thailand Automotive Logistics Market

India Automotive Logistics Market

Europe Retort Packaging Market

Asia-Pacific Vanilla (B2C) Market

Asia-Pacific Gloves Market

Europe Radioimmunoassay Market

Europe Hoses Market

U.S. and Europe Cartilage Regeneration Market

Dubai and Saudi Arabia Wood Based Panel Market

U.S., U.K., U.A.E., Mexico, India and Philippines Gift Card Market

Asia-Pacific Crop Protection Products Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com