Off Highway Vehicles Market Forecast: Technology and Sustainability to Shape Future Growth 2032

Global Off-Highway Vehicles (OHV) Market Size, Share, and Growth Outlook (2025–2032)

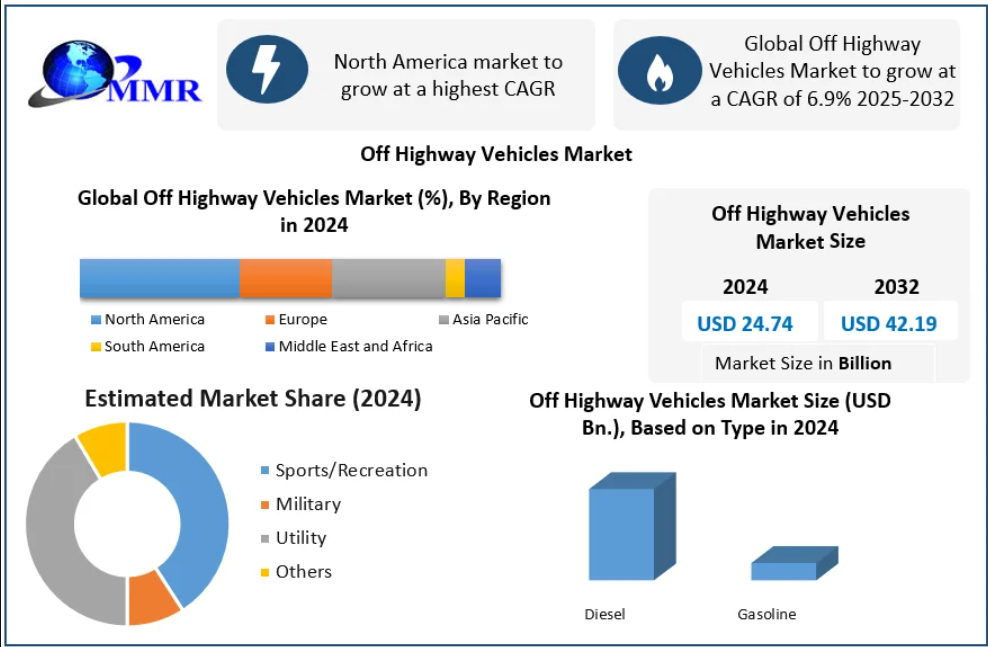

The Global Off-Highway Vehicles Market was valued at USD 24.74 billion in 2024 and is expected to reach USD 42.19 billion by 2032, growing at a CAGR of 6.9% during the forecast period. The market’s expansion is primarily driven by rapid industrialization, infrastructure development, modernization of agriculture, and the adoption of smart, eco-friendly machinery.

Market Overview

Off-highway vehicles (OHVs) comprise heavy-duty machines such as excavators, bulldozers, loaders, tractors, and harvesters, designed for off-road operations in construction, mining, and agriculture. These machines form the backbone of industrial and rural development, powering activities that drive national economies.

The increasing global push toward sustainable infrastructure, combined with digital transformation across industrial equipment, is reshaping the OHV landscape. Governments are investing heavily in public works and rural development programs, while manufacturers are integrating AI, telematics, electrification, and automation into their product lines.

In 2024, North America dominated the global OHV market, supported by robust construction activity in the U.S. and Canada, adoption of AI-driven fleet management solutions, and strong participation from leading OEMs such as Caterpillar Inc., Deere & Company, and CNH Industrial.

To identify the key high-growth segments, request your complimentary sample report by clicking here:https://www.maximizemarketresearch.com/request-sample/74216/

Market Dynamics

1. Drivers: Urbanization and Infrastructure Development

The steady increase in urbanization and housing demand has accelerated infrastructure development projects globally. Both private and public sectors are investing heavily in roads, smart cities, and utilities. This surge in construction activity directly fuels OHV demand. Additionally, the trend toward leasing or renting heavy machinery, instead of purchasing, has improved affordability for small and mid-sized contractors.

2. Opportunities: Industrialization and Technological Integration

Emerging economies are focusing on industrialization and energy projects, creating substantial opportunities for OHV manufacturers. In particular, the use of hybrid and electric OHVs in mining, hydropower, and tunneling projects is gaining traction. Advanced telematics and data analytics tools are now standard features, offering real-time performance tracking and predictive maintenance capabilities.

3. Challenges: Electrification Costs and Supply Chain Issues

Despite growing demand, the industry faces challenges including high R&D costs for electrification, supply chain disruptions (especially for semiconductors and battery materials), and uneven infrastructure for charging electric OHVs. Compliance with stringent emission norms and differing regional standards further complicates product development and scaling strategies.

Segment Analysis

By Fuel Type

-

Gasoline: Dominated the market in 2024, particularly for lightweight OHVs used in recreation and utility applications. Its affordability and refueling convenience make it a preferred choice.

-

Diesel: Expected to grow steadily due to its suitability for heavy-duty construction and agricultural machinery requiring high torque and durability.

By Application

-

Recreation: Accounted for the largest share in 2024, driven by rising interest in outdoor adventure sports and leisure activities. Post-pandemic lifestyle changes and increased spending on recreational mobility are supporting this segment.

-

Utility and Construction: Expected to grow rapidly due to widespread use in mining, forestry, and agriculture sectors, especially in developing nations.

By Horsepower (Construction Machinery)

-

Up to 100 HP: Suitable for small-scale construction and utility tasks.

-

200–400 HP: Expected to register the fastest growth due to expanding industrial and mining operations requiring high-power machinery.

Regional Insights

North America

North America remains the largest regional market, supported by significant construction spending, precision agriculture adoption, and infrastructure funding through initiatives such as the U.S. Bipartisan Infrastructure Law (USD 1.2 trillion). Advanced automation and electrification projects by Caterpillar, Deere, and CNH Industrial further strengthen the region’s leadership.

Europe

Europe’s market is driven by sustainability mandates, emission control regulations, and adoption of electric and hybrid machinery. Companies like Volvo CE, JCB, and Liebherr are pioneers in electric construction equipment and telematics solutions.

Asia-Pacific

APAC is projected to be the fastest-growing region, fueled by massive urbanization, agricultural modernization, and government-funded infrastructure programs in China, India, and Southeast Asia. Global giants such as Komatsu, Sany, and Hitachi Construction Machinery dominate the region, while emerging manufacturers are entering the low-cost OHV segment.

Middle East & Africa

Increased mining and oil exploration activities in GCC countries, coupled with road and infrastructure investments, are contributing to OHV market expansion.

South America

The region shows gradual growth, with Brazil and Chile focusing on mining and agricultural mechanization to enhance productivity.

To identify the key high-growth segments, request your complimentary sample report by clicking here:https://www.maximizemarketresearch.com/request-sample/74216/

Competitive Landscape

The global OHV market is moderately consolidated, led by multinational manufacturers with strong R&D capabilities and global supply chains.

Key Players:

-

Caterpillar Inc. (USA) – Leader in autonomous haulage systems and hybrid machinery.

-

Deere & Company (USA) – Pioneer in precision agriculture and telematics integration.

-

CNH Industrial (Italy/USA) – Expanded precision guidance through Hemisphere GNSS acquisition.

-

Komatsu Ltd. (Japan) – Developing all-electric loaders and autonomous mining vehicles.

-

Volvo Construction Equipment (Sweden) – Innovator in hybrid hydraulic systems.

-

Liebherr Group (Germany) – Focused on energy-efficient, electric drive solutions.

-

Sany Heavy Industry (China) – Rapidly expanding in construction and mining OHVs.

-

JCB Ltd. (UK) – Advancing compact electric machinery for urban construction.

Recent Developments

-

April 2025: Caterpillar Inc. unveiled autonomous haul trucks with advanced AI safety features.

-

March 2025: Komatsu Ltd. launched an all-electric compact wheel loader to support zero-emission construction.

-

February 2025: Volvo CE introduced a hybrid excavator achieving 20% fuel savings.

-

January 2025: Deere & Company enhanced its JDLink™ telematics with predictive maintenance tools.

-

February 2025: CNH Industrial completed its acquisition of Hemisphere GNSS to expand precision agriculture capabilities.

Emerging Market Trends

| Category | Key Trend | Example Product | Market Impact |

|---|---|---|---|

| Electrification | Rising adoption of electric & hybrid OHVs | Komatsu Electric Mini Excavator | Reduces emissions and operational costs |

| Autonomous Operation | AI-based autonomous systems | Caterpillar Command for Hauling | Boosts productivity and safety |

| Smart Telematics | Real-time IoT-based monitoring | John Deere JDLink™ | Enables predictive maintenance and fleet optimization |

Conclusion

The Global Off-Highway Vehicles Market is entering a transformative phase characterized by automation, electrification, and data-driven innovation. With strong growth expected through 2032, the industry will continue to evolve toward sustainable, intelligent, and connected machinery, shaping the future of construction, agriculture, and mining worldwide.