Drilling Tools Market Insights: Expanding Applications in Energy and Mining Industries 2030

Global Drilling Tools Market Size, Share, and Growth Analysis (2024–2030)

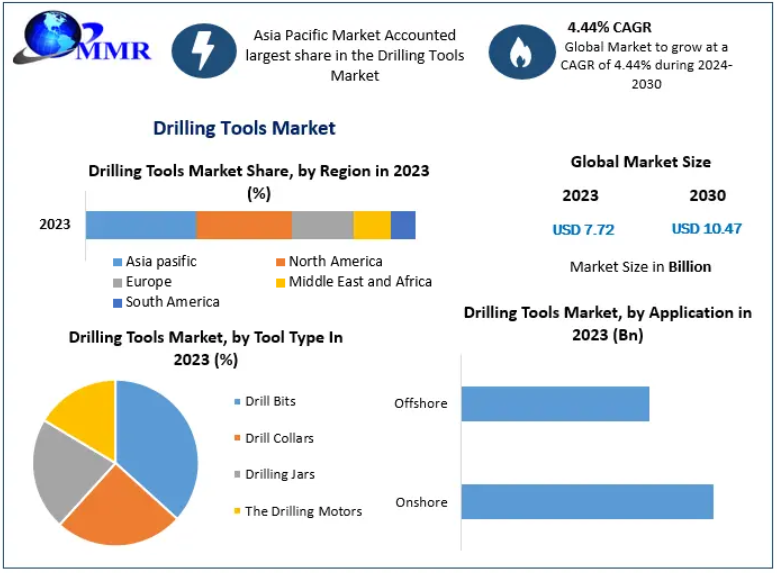

The Global Drilling Tools Market was valued at USD 7.72 billion in 2023 and is projected to reach USD 10.47 billion by 2030, expanding at a CAGR of 4.44% during the forecast period (2024–2030). The market’s growth is driven by a resurgence in oil and gas exploration activities, increasing focus on energy security, and advancements in drilling technologies that enhance efficiency and reduce operational costs.

Market Overview

Drilling tools are critical components used in oil & gas exploration, mining, and construction industries. These tools facilitate the drilling of boreholes in the earth’s subsurface, enabling the extraction of hydrocarbons and minerals. In recent years, the market has benefited from the global revival of exploration and production (E&P) operations, particularly in regions like North America, the Middle East, and Asia-Pacific, where both conventional and unconventional resources are being aggressively developed.

The COVID-19 pandemic temporarily disrupted drilling activities due to restrictions on movement and supply chain constraints. However, post-pandemic recovery has been strong, supported by rising global energy demand, stabilization of oil prices, and renewed investments in upstream oilfield projects.

Technological advancements—such as directional drilling, measurement-while-drilling (MWD), and real-time data analytics—have significantly improved drilling precision and efficiency, thereby reducing downtime and operational risks.

To identify the key high-growth segments, request your complimentary sample report by clicking here:https://www.maximizemarketresearch.com/request-sample/26106/

Market Dynamics

1. Drivers: Growing Oil & Gas Exploration and Energy Security Initiatives

The rising global demand for hydrocarbons, coupled with heightened concerns over energy security, is propelling investments in exploration and production (E&P) projects. The surge in shale gas exploration in the U.S., offshore developments in the Middle East, and expanding drilling activities in India and China are fueling demand for high-performance drilling tools.

Additionally, governments and private operators are investing in advanced drilling machinery to optimize well performance, reduce environmental impact, and ensure operational safety.

2. Opportunities: Industrial Automation and Advanced Manufacturing

Growing industrial automation and the increasing demand for precision-engineered machinery are creating new opportunities for the drilling tools market. Developments in CNC machining, metallurgy, and tool coating technologies have enhanced tool longevity and performance. Furthermore, government initiatives promoting the machine tools industry in countries like India and China offer additional growth prospects for domestic manufacturers.

3. Challenges: Shift Toward Renewable Energy and Regulatory Pressures

While the drilling tools market remains vital to the global energy mix, the transition toward renewable energy sources poses a long-term challenge. Regulatory pressures concerning carbon emissions and environmental conservation are leading to stricter drilling regulations. Additionally, price volatility in crude oil markets continues to influence exploration budgets and investment decisions.

Segment Analysis

By Tool Type

-

Drill Bits – Account for the largest market share due to high usage frequency and wear rates.

-

Drilling Tubulars – Expected to register the highest CAGR during the forecast period, driven by advancements in deepwater and horizontal drilling operations.

-

Drilling Motors and Jars – Critical for efficient torque generation and directional control in complex wells.

-

Drill Collars and Stabilizers – Essential for weight transfer and maintaining borehole stability.

By Application

-

Onshore – Dominated the market in 2023, attributed to cost-effectiveness and operational simplicity compared to offshore drilling. The onshore segment benefits from a large number of shale and conventional projects in North America and Asia-Pacific.

-

Offshore – Expected to grow steadily with renewed investments in deepwater and ultra-deepwater projects in regions such as the Gulf of Mexico, Brazil, and West Africa.

Regional Insights

Asia-Pacific (APAC)

The Asia-Pacific region is expected to witness the fastest growth due to increased drilling activities in China, India, and Indonesia. Governments are actively developing shale gas and unconventional resources to enhance domestic energy production. Rapid industrialization and modernization of drilling operations are also contributing to regional expansion.

North America

North America continues to be a key market, driven by shale gas production in the U.S. and Canada. The region’s technological leadership in advanced drilling systems, supported by major oilfield service companies, makes it a hub for innovation.

Europe

Europe’s market is steady, supported by ongoing exploration in the North Sea and government incentives for energy efficiency and sustainable extraction practices.

Middle East & Africa

The Middle East remains a major hub for oilfield drilling, supported by abundant reserves and continued investments by national oil companies (NOCs) such as Saudi Aramco and ADNOC. Africa’s offshore drilling projects in Nigeria, Angola, and Egypt further contribute to market growth.

South America

Brazil and Argentina are leading drilling activities in Latin America, particularly in offshore pre-salt reserves and shale formations.

To identify the key high-growth segments, request your complimentary sample report by clicking here:https://www.maximizemarketresearch.com/request-sample/26106/

Competitive Landscape

The global drilling tools market is moderately consolidated, with leading companies focusing on innovation, automation, and sustainability to enhance competitiveness. Strategic collaborations, mergers, and product launches are key growth strategies.

Key Players:

-

Schlumberger Limited

-

Halliburton Company

-

Baker Hughes (a GE Company)

-

National Oilwell Varco, Inc.

-

Sandvik AB

-

Epiroc AB

-

Tenaris SA

-

TMK IPSCO Enterprises Inc.

-

Vallourec SA

-

Cougar Drilling Solutions

-

United Drilling Tools Ltd.

-

Drilling Tools International

-

Rubicon Oilfield International

-

Dynomax Drilling Tools

-

Weatherford International

These companies are investing heavily in digital oilfield technologies, automation, and high-performance alloys to improve drilling accuracy, reduce downtime, and extend tool life.

Conclusion

The Global Drilling Tools Market is poised for steady growth through 2030, supported by rising global energy demand, new oilfield discoveries, and the increasing adoption of digital drilling technologies. While the shift toward renewable energy introduces long-term challenges, continuous innovation in tool design, automation, and efficiency ensures that drilling tools remain an indispensable part of the global industrial landscape.