Contract Logistics Market Poised for Strong 7.6% CAGR Growth by 2032

Global Contract Logistics Market – Driving Efficiency, Technology, and Growth Across the Supply Chain

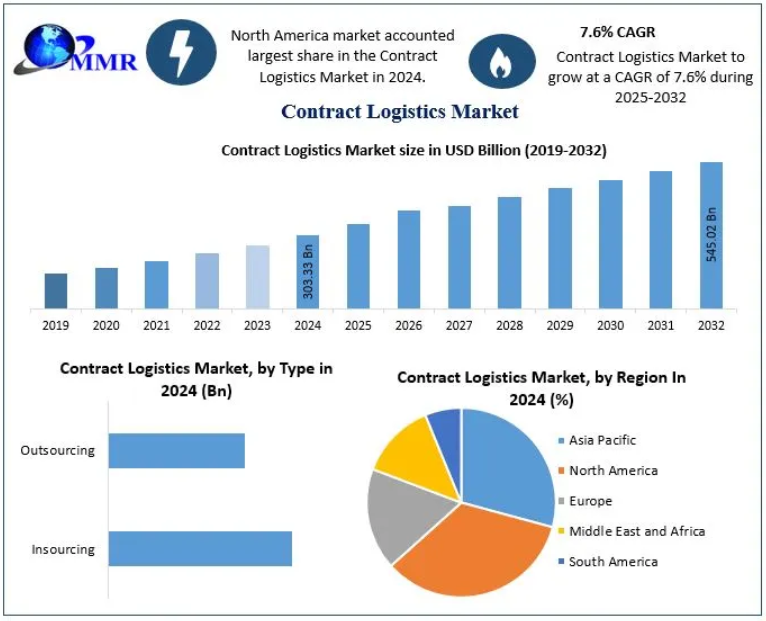

The Global Contract Logistics Market was valued at USD 303.33 billion in 2024 and is projected to reach USD 545.02 billion by 2032, expanding at a CAGR of 7.6% during the forecast period. The growing complexity of supply chains, rising e-commerce demand, and technological advancements such as AI, IoT, and blockchain are transforming the logistics landscape, positioning contract logistics as a key enabler of operational excellence and business agility.

Market Overview

Contract logistics refers to long-term, strategic partnerships between logistics providers and manufacturers or retailers to manage end-to-end supply chain operations — from warehousing and transportation to order fulfillment and after-sales services. By outsourcing logistics to specialized third-party providers (3PLs), companies can focus on their core business while improving efficiency, scalability, and cost management.

Contract logistics providers act as an integral extension of the client’s business, offering tailored solutions for storage, distribution, and customer delivery. These services are particularly vital for industries with high logistics intensity, such as e-commerce, retail, manufacturing, automotive, and pharmaceuticals.

The market’s strong growth trajectory is driven by the ongoing digitalization of logistics operations, coupled with the rapid expansion of global trade and the increasing emphasis on sustainability and real-time visibility.

Access your free report sample — uncover the top-performing segments today@https://www.maximizemarketresearch.com/request-sample/165033/

Market Dynamics

Key Drivers

-

Technological Advancements Reshaping Logistics Operations

The increasing integration of Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and Cloud Computing is redefining contract logistics. AI enables smarter decision-making in route optimization, demand forecasting, and inventory management, while IoT enhances real-time visibility and performance monitoring across supply chains.Cloud-based logistics platforms offer centralized control, real-time data synchronization, and scalability. The adoption of SaaS (Software-as-a-Service) models allows businesses to transition from traditional on-premise systems to more flexible, cost-efficient solutions, accelerating digital transformation across the logistics industry.

-

AI-Driven Automation and Robotics

Warehousing automation has seen massive investment from global giants. For instance, Alibaba invested $15 billion in robotic logistics infrastructure, while Google invested $500 million in JD.com’s automated logistics operations. Warehouse robotics — projected to reach USD 22.4 billion in market value — are streamlining order fulfillment, reducing human error, and improving delivery speeds. -

Blockchain for Transparency and Trust

Blockchain technology is enabling secure, traceable transactions and transparent communication between supply chain partners. By eliminating intermediaries and digitizing records, blockchain enhances trust, reduces costs, and simplifies auditing processes in contract logistics operations. -

E-commerce and Omni-channel Fulfillment Boom

The e-commerce sector continues to be a major growth driver. As online retail expands, businesses demand logistics partners capable of managing complex, high-frequency order fulfillment and last-mile delivery. The need for multi-channel distribution networks and real-time order visibility has made contract logistics indispensable for online and offline retail integration.

Market Challenges

Despite strong growth prospects, the contract logistics market faces certain constraints:

-

Rising operational costs due to warehouse shortages and increasing rental prices.

-

Labor shortages and the need for upskilling workers to manage technology-driven logistics systems.

-

Pressure for same-day delivery models, demanding faster and more efficient logistics solutions.

However, the growing use of automation, predictive analytics, and cloud infrastructure is helping companies overcome these challenges and optimize logistics performance.

Segment Analysis

By Service:

-

Transportation

-

Warehousing – The largest segment, driven by the expansion of 3PL providers and demand for flexible, shared facilities.

-

Distribution

-

Aftermarket Logistics – Increasingly important for reverse logistics and returns management in e-commerce.

By Type:

-

Outsourcing (Dominant Segment): Enables businesses to reduce costs, enhance flexibility, and focus on core competencies.

-

Insourcing: Preferred by large enterprises seeking full control over logistics operations.

By Industry Vertical:

-

E-Commerce (Largest Market Share): Fueled by online retail expansion and growing consumer expectations for fast, accurate deliveries.

-

Retail: Leveraging logistics partnerships for multichannel fulfillment.

-

Manufacturing: Adopting contract logistics for global supply chain synchronization.

-

Others: Automotive, pharmaceuticals, and consumer goods are emerging growth segments.

Access your free report sample — uncover the top-performing segments today@https://www.maximizemarketresearch.com/request-sample/165033/

Regional Insights

North America (Dominant Market)

Holding a 45% share in 2024, North America leads the global market due to the presence of established logistics providers and advanced warehousing infrastructure. The surge in e-commerce and demand for same-day delivery has accelerated outsourcing among retailers and manufacturers.

Key players like DHL, FedEx, XPO Logistics, and Ryder System continue to invest heavily in warehouse automation and digital logistics platforms across the U.S. and Canada.

Europe (Second Largest Market)

Europe remains a mature yet dynamic market, driven by demand for integrated and sustainable logistics solutions. Germany, as the region’s industrial hub, leads contract logistics adoption, while Central and Eastern Europe are emerging as cost-effective alternatives for warehouse expansion and supply chain diversification.

Asia Pacific (Fastest-Growing Market)

Asia Pacific is witnessing exponential growth due to booming e-commerce, manufacturing expansion, and increased cross-border trade in China, India, Japan, and South Korea. The proliferation of 3PL providers and digital logistics startups is reshaping the regional logistics landscape.

Competitive Landscape

The global contract logistics market is highly competitive and fragmented, with both multinational and regional players competing through service innovation, digital transformation, and mergers and acquisitions.

Leading Market Players:

-

DHL Supply Chain

-

DB Schenker

-

CEVA Logistics

-

Agility

-

DSV

-

Kuehne + Nagel

-

XPO Logistics

-

Ryder System, Inc.

-

UPS Supply Chain Solutions

-

Yusen Logistics

-

GEODIS

-

Hitachi Transport System

-

Penske

-

Neovia Logistics Services

Key strategies include the expansion of automated facilities, investment in AI-powered platforms, and strategic partnerships with e-commerce and manufacturing clients to enhance last-mile and omnichannel delivery capabilities.

Future Outlook

The global contract logistics industry is on the cusp of a technological revolution. The integration of AI, blockchain, robotics, and cloud computing will continue to redefine efficiency, visibility, and scalability in logistics operations. As companies seek sustainability, flexibility, and speed, contract logistics providers will evolve from traditional 3PL roles to end-to-end supply chain partners offering predictive, data-driven logistics ecosystems.

By 2032, digital innovation and increased outsourcing will make contract logistics a cornerstone of global trade efficiency, empowering businesses to achieve faster deliveries, smarter operations, and sustainable growth.